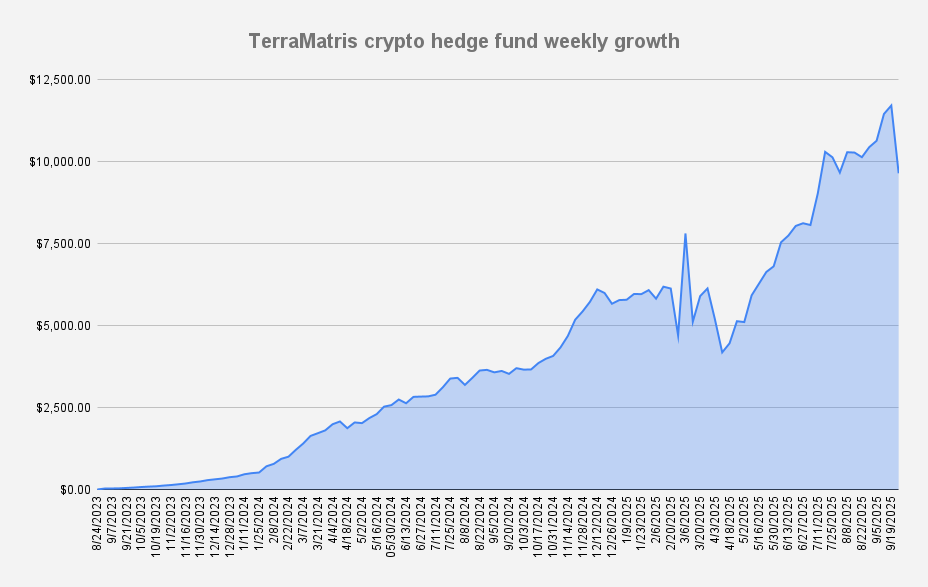

Solana Covered Call Growth Fund Performance - September 2025

The Terramatris Solana Covered Calls Growth Fund launched on September 4, 2025, with an initial seed contribution of $100. September marked the Fund’s first month of operations, with the onboarding of seven subscribers and the issuance of 5,973 NAV units, bringing total Assets Under Management (AUM) to $5,536.

The Fund remains open to new capital commitments until it reaches $100,000 in AUM. TerraM Fund, one of our core investors, has committed to ongoing biweekly contributions of $100 through at least September 2026.

- Read more about Solana Covered Call Growth Fund Performance - September 2025

- Log in to post comments

- 18 views