Crypto Options

Crypto Options Prediction Bot — Inside Our Next-Gen AI Trading Engine

| 67 seen

At Terramatris, we’ve spent years exploring the intersection of quantitative finance, machine learning, and blockchain markets.

Our latest internal project - Crypto Options Prediction Bot - represents a major leap in how AI can analyze and rank crypto options across Deribit in real time.

Unlike retail “signal” bots, our bot doesn’t guess. it learns, measures, and scores every BTC and ETH options contract based on statistical probabilities, expected returns, and volatility dynamics.

Fetches live Deribit options data for BTC and ETH every week.Filters all contracts with Friday…Trading Covered Calls on XRP with Deribit

| 152 seen

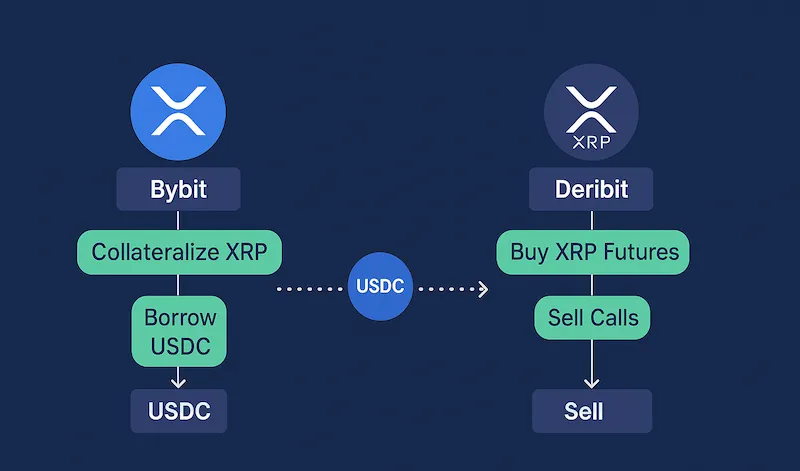

At Terramatris we are always exploring new ways to structure option strategies around crypto assets. One of the more interesting challenges we’ve faced recently is figuring out how to trade covered calls on XRP.

Our favorite trading platform, Bybit, unfortunately does not yet offer XRP options. That left us looking for alternatives, and naturally, Deribit became our next candidate. Deribit does offer XRP options, but as always, the devil is in the details.

The Challenge: Collateral Rules on DeribitDeribit lists XRP options, but they are settled in USDC. At the time of writing,…

Selling Covered Calls on Borrowed Bitcoin: Strategic Yield with Asymmetric Risk

| 75 seen

On May 25, 2025, we executed a position that perfectly illustrates a niche but compelling setup in the crypto derivatives space. We:

Borrowed 0.01 BTC (worth $1,080 at the time),Posted 0.54 ETH as collateral (worth $1,350),And sold a cash-settled call option on 0.01 BTC with a strike price of $110,000,Collecting a premium of $17 with weekly expiry (May 30).Let’s break down the rationale, benefits, risks, and variations of this strategy — and why, despite its synthetic nature, it can be a valuable tool in Terramatris' option yield strategies.

The Core StrategyThe basic idea is…

How to Sell a Synthetic Covered Call on ETH

| 261 seen

At TerraMatris Crypto Hedge Fund, we actively deploy a range of options strategies to generate income and manage directional exposure. Today, I want to share an elegant and capital-efficient technique we’re using: the synthetic covered call—a method that replicates the payoff profile of a traditional covered call, without the need to hold the underlying crypto asset.

What Is a Synthetic Covered Call?Traditionally, a covered call involves owning a crypto asset (like ETH) and selling a call option against it. This generates premium income while capping upside beyond the strike price.…