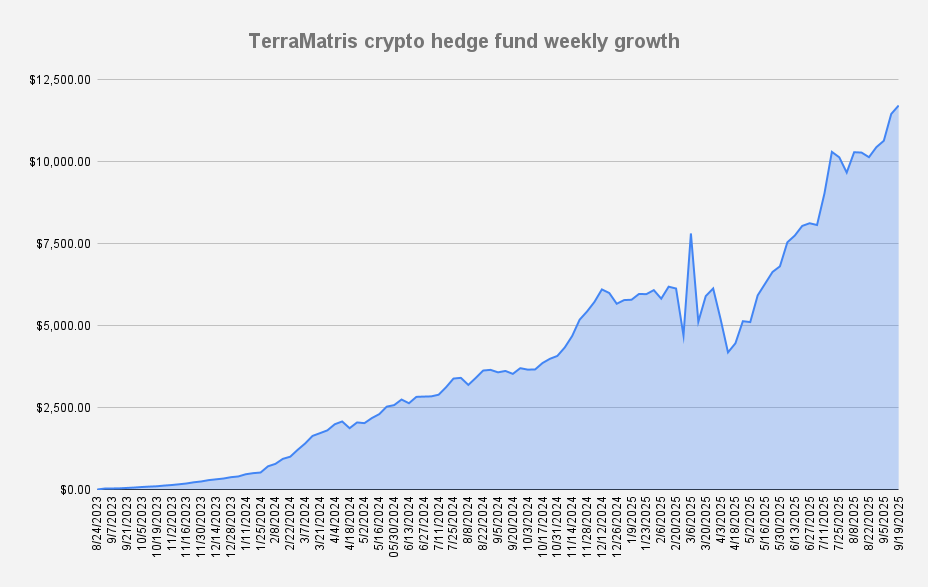

As of September 19, 2025, the TerraM crypto fund value stood at $11,719 what is an increase of +2.25% or +$257 in dollar terms when compared to the last week. Absolutely brilliant!

Last few weeks have been quite rewarding in crypto markets, with some type of consolidation forming.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our main TerraM fund is +106.33%. If the yearly pattern holds, we may be at the beginning of a run heading into Q4 2025. That said, we remain grounded and cautious.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $160 from options premiums, translating to a 1.36% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

With one week left in September, we anticipate a boost in options premiums as both weekly and monthly contracts approach expiry and are set to expire worthless. Our target for next week is in the range of $300–$400.

Trades in Adjustment (USDT Settled / Weekly)

- 1.6 ETH – Break-even: $4,694 | Short puts: $4,300

- 13 SOL – Break-even: $229.96 | short puts: $225

Similar to last week, we maintained a slightly more aggressive stance with ETH puts this week, and there remains a possibility that we may need to adjust the position in the coming week.

TerraM token

There hasn’t been much movement in the TerraM token price this week. We plan to initiate treasury operations once the total fund value reaches $12,000.

- Solana blockchain

- Fully Diluted Market cap: $32,600

- Total supply: 10,000

- In circulation: 1,933 (19.33%)

- On Liquidity pool: 471 (4.71%)

- Price per token: $3.26

Solana Covered Call Growth fund

Our newly established Solana Covered Call Fund increased its NAV from $1.11 to $1.14 over the past week. In addition, we welcomed three new subscribers. While their initial commitments were below our $5,000 minimum threshold, we granted a waiver under the agreement that the required minimum will be reached within two years.

We have also resolved to keep the fund open to subscriptions until it reaches $100,000 in total value. With current assets under management at $510, we are already 0.51% of the way toward our target. This marks a solid increase compared to the previous week, driven by support from the existing Terramatris community.

Nevertheless, the fund remains high-risk, as it is closely tied to the performance of Solana. A significant drop in Solana’s price would directly impact the fund’s value. At present, Solana appears to be overbought, which adds to the risk profile. We are not ruling out the possibility that Solana could retrace to around $195 per coin, based on its 50- and 200-day moving averages.

Disclaimer: This communication is strictly confidential and intended solely for its designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein does not constitute investment advice and is provided for informational purposes only. Participation is restricted, and this material is not directed at or intended for distribution to citizens or residents of the United States.