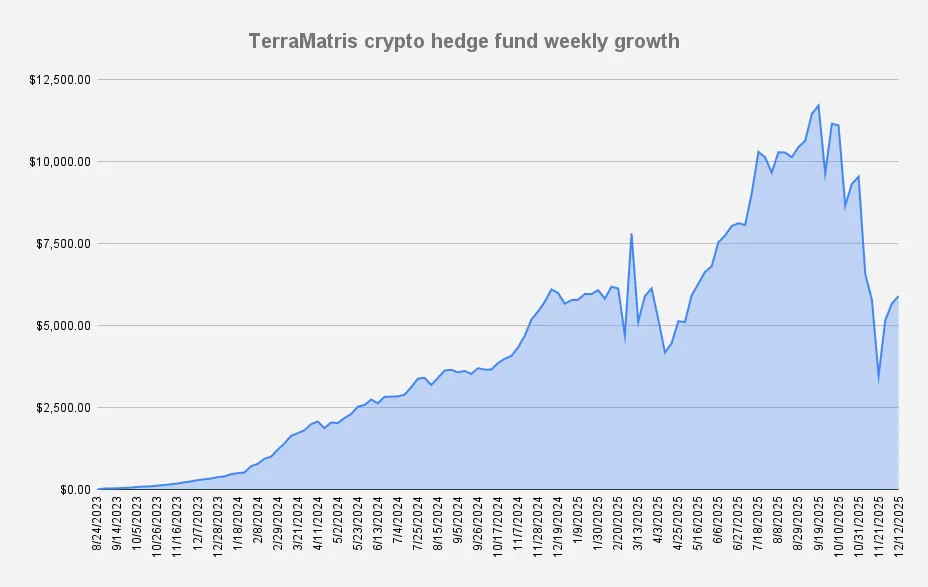

As of December 12, 2025, the TerraM Multi-Asset Crypto Options Fund is up +3.94% week-over-week, encouraging result after the steep drawdown just a few weeks ago.

Our overall drawdown stands at –49%, while YTD Fund value is up +3,98%, slightly outperforming Bitcoin (–1.29%) and ETH (–2.65%). This highlights that our returns remain highly directional and strongly correlated with the broader market - largely “riding the wave” while seeking to extract incremental income through our yield/option overlays.

Options Income

This week, the TerraM Multi-Asset Fund generated $170 in options premiums, what is impressive 2.87% weekly return on capital.

Over recent weeks we sold ATM covered calls below our break-even. This week we were challenged and had to roll up and out; we still collected net credit, but it highlighted the classic trade-off—premium income vs capped upside, with the other risk being turning into a bagholder in a drawdown.

The good thing is we rolled 2.2 ETH of calls up from 3,150 to 3,200 while still collecting premium—so we’ve effectively added about $200 of potential value for next week (~$110 from the higher strike if called away + ~$90 premium), and in case if ETH doesn’t hold above 3,200, we still got paid.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Long Calls | Short Puts |

|---|---|---|---|---|

| ETH | 2.4 ETH | $3,591 | $3,100 (0.6), $3,200 (1.5), $3,800 (0.2) | $3,800 (0.1) |

| SOL | 19 SOL | $185.79 | $144 | — |

| BTC | 0.02 BTC | $109,325 | $96,500 | — |

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

Unlike previous weeks, we didn’t convert perps to spot this week, because we’re also prioritizing a reduction in our margin debt, which currently stands at -2,758 USDT (as of today). If we can consistently set aside $170 per week, we’ll eliminate our margin debt in about 16 weeks.

Solana Covered Call Growth Fund

Surprisingly but our open-ended Solana Covered Call Growth Fund declined slightly by -0.32%, while still keeping the NAV per unit flat at $0.76. At the end of week we were able to increase our long spot holdings to 36.82 SOL with break even price $174.2

Options selling generated $34.72 this week all reinvested into spot SOL.

Our goal is to gradually grow the fund to 100 SOL. Although we have liquid cash available, we remain cautious about unexpected market moves. The main challenge with SOL options is limited liquidity and a lack of suitable roll dates when positions come under pressure. The all options premium made this week comes from Selling January 30, 2026 covered calls. As an alternative, we’re also considering allocating part of the portfolio to DeFi for staking rewards. In the meantime, we continue to accumulate SOL slowly and methodically.

TerraM token

Our native TerraM token held steady at $3.27. This week, we added some liquidity back to the Raydium liquidity pool, allocating 20% of the TerraM Multi-Asset Fund’s options income to support it.

What else happened this week

This week we launched our strategic partnership search: we posted a role on LinkedIn and received 12 applications from highly relevant crypto professionals who shared their CVs and expressed interest. Unfortunately, we haven’t formed a partnership yet, as most candidates were looking for a salaried position or declined our offer. We’re not discouraged, though – it was a valuable learning experience, and we also grew our LinkedIn company page by around 10 new, crypto-focused followers, which is a positive result.

Additionally, we had planned to attend the ETH Tbilisi meetup on Wednesday, but it was cancelled at the last minute. Afterwards, we received an invitation to another crypto event organized by Futuruma, which we decided to skip this time.

We’ve been attending crypto events for the past few years, and it’s hard to say whether we actually like them or not. We haven’t found any real partnerships there yet, but we have been pitched a lot. Either we’re not good at upselling, or we keep ending up in the wrong pools.

The Bottom Line

No victory lap—just steady execution, risk management, and continued grinding back from the drawdown.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.