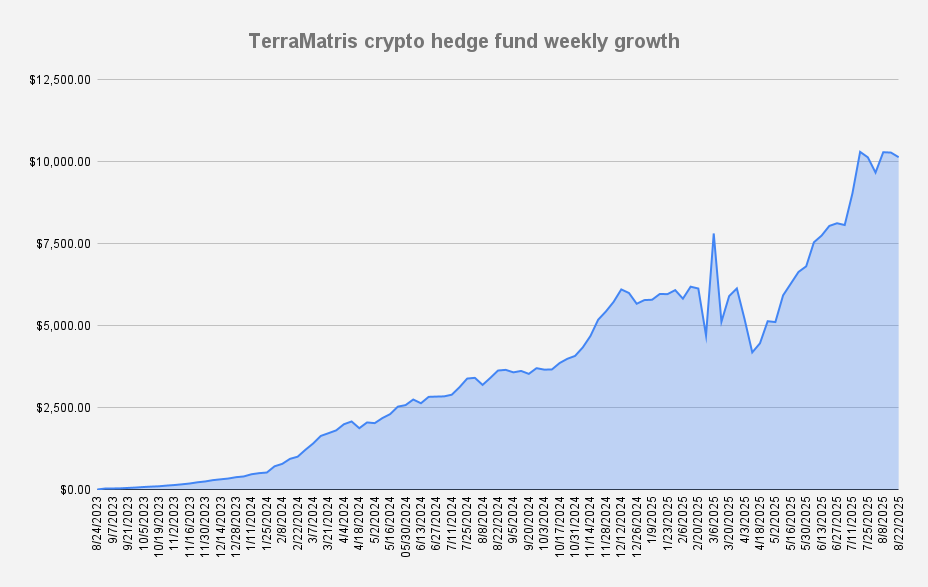

As of August 22, 2025, the Terramatris crypto hedge fund value stood at $10,142 what is a decrease of -1.37% or -$140 in dollar terms when compared to the last week.

The past week has been quite turbulent, with Ethereum fluctuating between 4,600 and 4,000. At one point, we even considered hedging by shorting part of our position with perpetual contracts, but ultimately decided against it. The week ended on a positive note, as all of our weekly options expired worthless. The decline in portfolio value mainly came from the depreciation of our long-term holdings.

Despite negative performance in crypto markets we are still just a few hundred dollars shy of our all-time high recorded earlier this summer—an encouraging sign of the fund’s resilience and upward momentum.

YTD our crypto hedge fund is +78.57%.

This week, we added new long position to our portfolio: Plume

We decided to gradually build small positions in this token because we believe it may have strong potential to grow significantly—possibly achieving 100x returns over the next five years.

This is not a trade recommendation; it simply reflects our strategic positioning and outlook.

As we want to grow our crypto hedge fund into the million-dollar territory, we need to actively identify promising projects today while also being willing to take opportunistic risks. To finance these positions, we allocate a small portion of our options premium income to such high-upside bets. The remainder continues to be deployed into more established assets like Bitcoin, Ethereum, and Solana, ensuring a balance between growth potential and long-term stability.

Current Long Perpetual Futures (USDT Settled)

- 1.7 ETH – Break-even: $4,497 | Short puts: $4,000 (0.7) and $3,900 (1)

- 13 SOL – Break-even: $190.22 | short puts: $175

We continue to anticipate a deeper market pullback, with a potential test of the 3600–3500 (for Ethereum) range in the coming weeks or months, as suggested by the technical charts.

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $170 from options premiums, translating to a 1.67% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

Looking ahead, we anticipate higher premiums next Friday with both weekly and monthly options expiring. We are targeting at least $300 in premium income for the week.

TerraM token

There hasn’t been much movement with our native TerraM utility token last week. We anticipate initiating treasury operations once the fund’s value reaches $12,000.

- Solana blockchain

- Fully Diluted Market cap: $32,600

- Total supply: 10,000

- In circulation: 1,681 (16.81%)

- On Liquidity pool: 410 (4.10%)

- Price per token: $3.26

Terramatris LLC may, from time to time, repurchase $TERRAM tokens from the open market for purposes such as liquidity pool management, ecosystem initiatives, or treasury operations. These activities are not intended as investment incentives and do not guarantee any future token value.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions