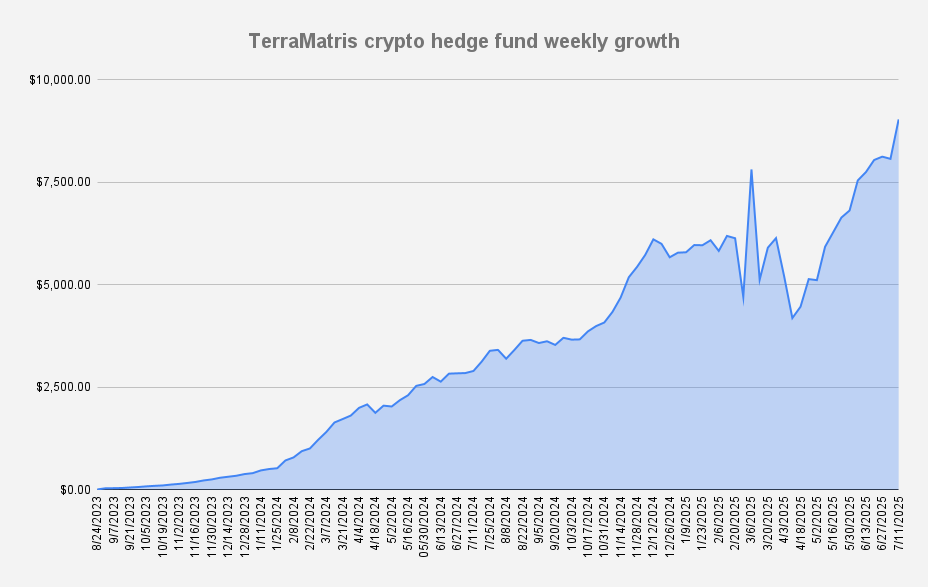

As of July 11, 2025, the Terramatris crypto hedge fund value has grown to $9,036 showing very strong weekly growth of +11.93% or +$963 in dollar terms. Week after week, we continue breaking milestones — and this week, we’ve set a new all-time high. Absolutely awesome! As we’ve just crushed several of our key milestones, another TerraM token buyback and liquidity boost is now in the pipeline.

Current Long Perpetual Futures (USDT Settled)

- 0.02 BTC – Break-even: $129,070 | Short puts: $112,000

- 1.8 ETH – Break-even: $3,448 | Short puts: $2,700

- 5 SOL – Break-even: $165.86 | Long calls: $156

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $155.47 from options premiums, translating to a 1.72% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

A major boost to our portfolio has come from the ongoing bull run in the crypto market. At the time of writing, Ethereum (ETH) is hovering around $3,000 — a sharp increase from $2,500 just a week ago. Since ETH remains the bread and butter of our portfolio, we’ve certainly benefited from this upswing. Nevertheless, as put sellers, we remain cautious.

In parallel, we successfully closed a synthetic covered call position originally opened at the end of May, realizing a gain of $400. We've now doubled down and opened a new synthetic covered call on Ethereum, with a $3,000 strike and an expiration at the end of September.

On the optimistic side, we're targeting a potential profit of $800–$1,000 by expiry. However, if the market crashes and ETH falls back to the $2,500–$2,000 range, we’ll be obligated to purchase 2 ETH at $3,000.

As always — trade safe.

TerraM Token Update

Having just surpassed the $9,000 milestone, our fund is taking the next strategic step forward.

We're contributing an additional $150 worth of TerraM tokens into the Raydium liquidity pool. This move is designed to reduce slippage and improve market depth by increasing the free float of TerraM.

In parallel, we’re preparing a modest token buyback to help tighten circulating supply — a step we believe will contribute to upward price momentum. Both the liquidity injection and the buyback are scheduled to be executed early next week.

Based on current projections, we anticipate a price increase of approximately $0.20 to $0.25 for TerraM in the coming weeks.

Thank you for your continued trust in the TerraM token and the vision we’re building together.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.