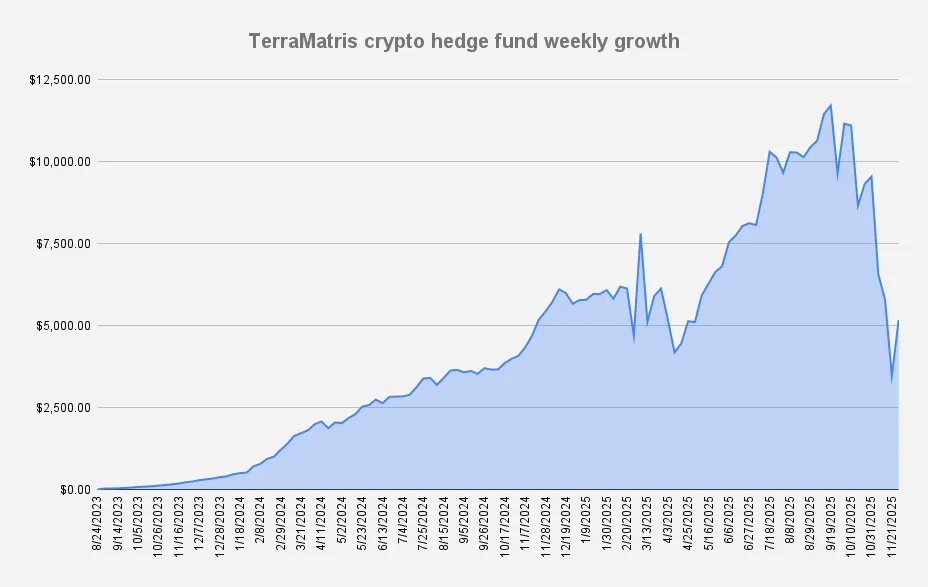

As of November 28, 2025, the TerraM Multi-Asset Crypto Options Fund is up +48.85% week-over-week, marking our strongest weekly gain to date. However, this surge is largely a retracement following last week’s –40% drawdown, rather than new growth.

Our overall drawdown has now improved to –55.87% - a meaningful recovery, though still far from the fund’s all-time high reached in mid-September. This past week offered welcome relief, and we hope the positive momentum continues, but we remain cautious and do not rule out the possibility of another sharp decline.

It has now been more than two years since we launched our crypto hedge fund, and while this is the steepest drawdown we have experienced, it is also the easiest to handle. Although leverage contributed to the size of the decline, we are not overleveraged.

In past drawdowns, we were forced to liquidate large portions of our holdings at a loss. This time, we have not sold anything. All long positions remain intact, although they are currently capped with in-the-money covered calls below our break-even levels.

Despite the volatility, we genuinely feel satisfied with the discipline, structure, and resilience we’ve built as a team.

Options Income

This week, the TerraM Multi-Asset Fund generated $273 in options premiums, what is impressive 5.2% weekly return on capital.

For the sake of transparency, the options income comes with certain trade-offs. We sold covered calls below our break-even levels. This means that if the market experiences a strong rally, we may forgo part of the upside potential.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Long Calls | Short Puts |

|---|---|---|---|---|

| ETH | 2.3 ETH | $3,644 | $3,100 (1.6) $3,800 (0.2) $4,200 (0.4) | $3,800 (0.1) |

| SOL | 19 SOL | $174.69 | $150 | — |

| BTC | 0.02 BTC | $111,185 | $94,000 | — |

This week we took assignment on our positions: one long perpetual futures position in ETH at $3,200 and six SOL at $170. We chose assignment instead of rolling because available premiums were too low to justify a roll. With the new positions added, we’re shifting to a more aggressive call-writing approach. These assignments also reduce our overall break-even levels.

Long perpetual positions are essentially placeholders in our portfolio. Over time, we aim to convert them into spot holdings. If the market justifies it and the price moves above our break-even level, we simply close the perpetuals for a profit instead.

Solana Covered Call Growth Fund

Our open-ended Solana Covered Call Growth Fund also followed recovery, growing +4.01%, with the NAV per unit now at $0.76. The fund operates without leverage, so the drawdown poses no structural risk — we simply ride out the market move. Additionally we are already holding 32.77 SOL with break even price $176.91

Options selling generated $83 this week all reinvested into spot SOL.

Our goal is to gradually grow the fund to 100 SOL. Although we have liquid cash available, we remain cautious about unexpected market moves. The main challenge with SOL options is limited liquidity and a lack of suitable roll dates when positions come under pressure. As an alternative, we’re also considering allocating part of the portfolio to DeFi for staking rewards. In the meantime, we continue to accumulate SOL slowly and methodically.

TerraM token

Algo traders pushed our native token to $3.27, which is great to see. Unfortunately, because we previously removed part of the liquidity from the Raydium pool to stabilize the overall fund, slippage increased significantly. We acknowledge this issue and are actively addressing it.

This week we added back liquidity, allocating 20% of the options income from the TerraM Multi-Asset Fund to the pool.

The Bottom Line

The fund delivered a strong rebound this week, but the recovery primarily reflects a retracement from last week’s sharp decline rather than fresh growth. Our overall drawdown has improved meaningfully, and we maintained all core long positions without forced selling — a key sign of structural resilience compared to past cycles. Options income remains robust, though capped calls limit near-term upside if markets surge. Both the Multi-Asset Fund and the Solana Covered Call Fund are stabilizing, with disciplined accumulation continuing across assets. TerraM token liquidity has been partially restored as well. We remain cautiously optimistic while preparing for potential volatility ahead.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.