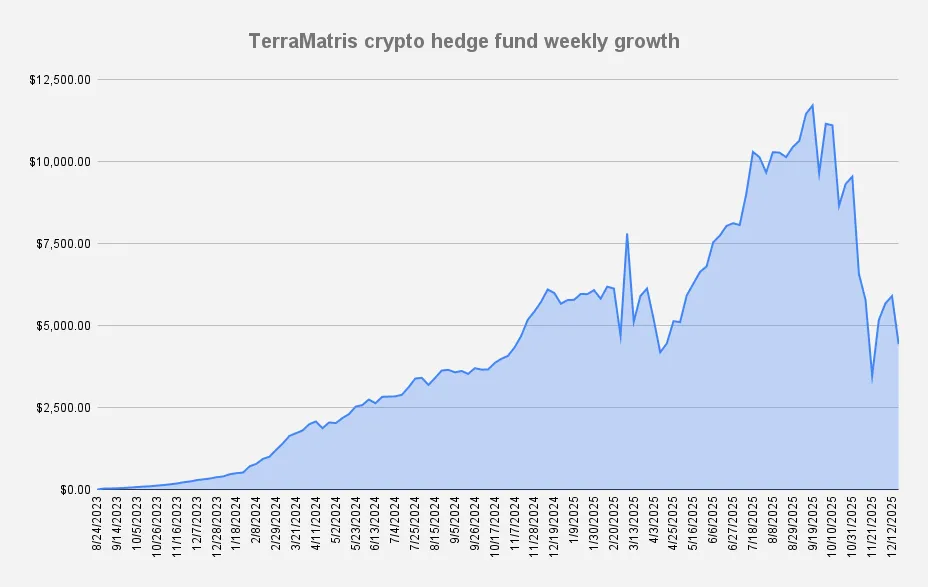

As of December 19, 2025, the TerraM Multi-Asset Crypto Options Fund is down (again) -24.86% week-over-week, discouraging result after brief relief for the past few weeks. Apparently the worst is not over. Unless momentum shifts, ETH likely revisits sub-$2,500 levels before any real recovery.

Overall drawdown is –62%. Year-to-date, the Fund is down –21.87%, underperforming Bitcoin (–6.97%) and ETH (–12.47%). This confirms our returns are still highly directional and closely correlated with the broader market—largely riding the wave, while aiming to add incremental income through our yield and options overlays. Leverage remains a double-edged sword: it can materially amplify gains in bull markets, but it also magnifies losses when the market turns against us.

Fortunately, our leverage is under control, and as long as we see some market recovery and can keep generating income from weekly options, we don’t see any structural problems in the fund itself. Moreover, this week we started adding put spreads as protection against potential downside. We’re not completely safe yet, but we’re getting better week after week through this recent selloff.

Options Income

This week, the TerraM Multi-Asset Fund generated $205 in options premiums, what is impressive 4.62% weekly return on capital.

Increased options income is coming from selling in-the-money covered calls below our breakeven, which boosts premium but caps upside.

This week we also added bull put spreads as a defined-risk downside buffer (i.e., protection against further declines) and adjusted the call side by partially selling calls above current levels and/or using shorter-dated calls.

If the market rebounds strongly next week, we’ll still participate in a portion of the upside, while having collected higher premium and keeping downside risk more structured.

Once we recover from these trades and begin adding new positions, we’ll focus more on vertical spreads and potentially iron condors.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Long Calls | Short Puts |

|---|---|---|---|---|

| ETH | 2.4 ETH | $3,528 | $3,000 (2,1), $3,800 (0.2) | $3,800 (0.1) |

| SOL | 19 SOL | $184.60 | $134 | — |

| BTC | 0.02 BTC | $106,750 | $92,000 | — |

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

We didn’t convert perps to spot this week, because we’re also prioritizing a reduction in our margin debt, which currently stands at -3,543 USDT (as of today). If we can consistently set aside $205 per week, we’ll eliminate our margin debt in about 17 weeks.

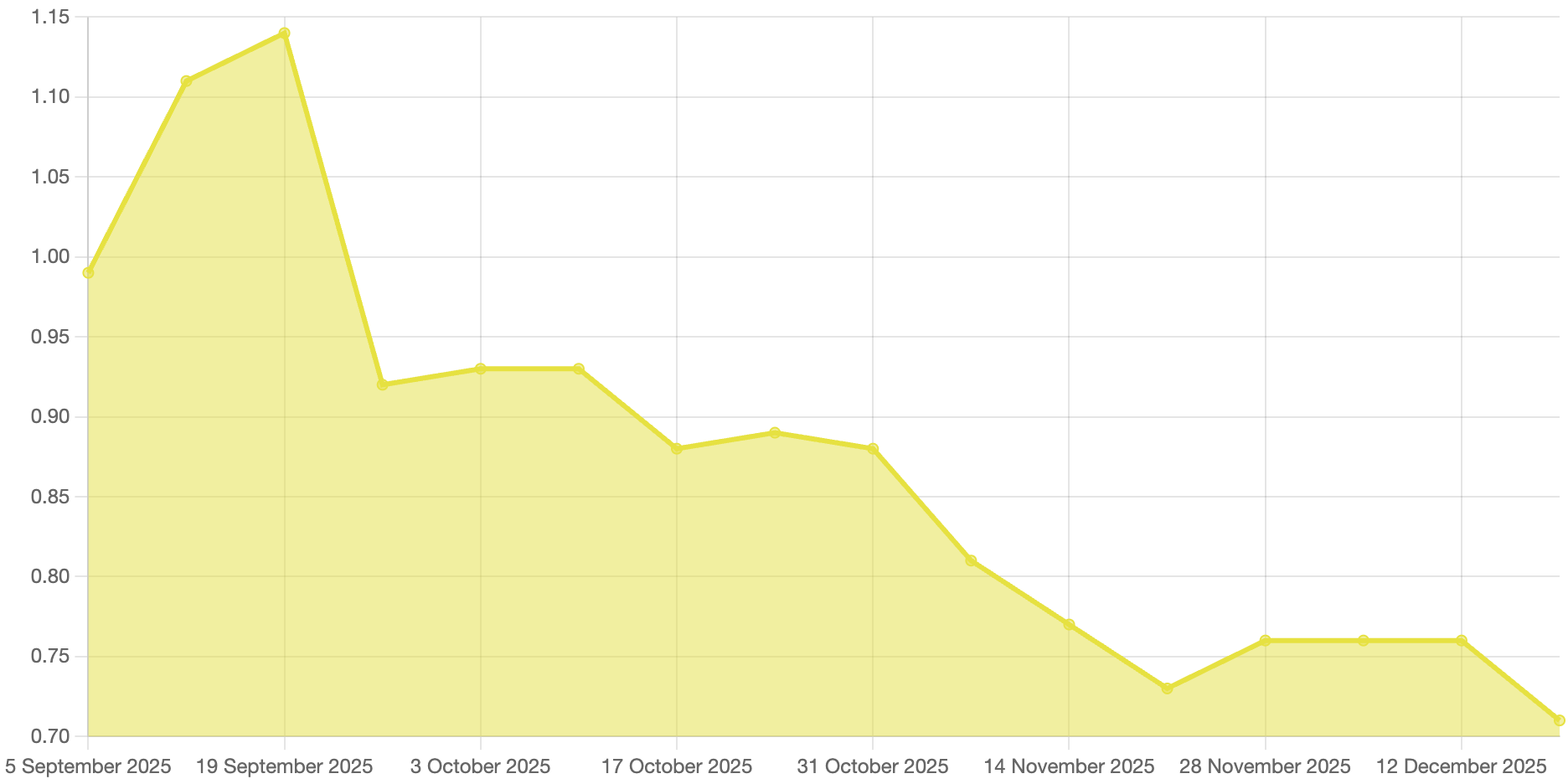

Solana Covered Call Growth Fund

Our recently launched Solana Covered Call Growth Fund declined another -6.79%, decreasing the NAV per unit to $0.71. While the end of week we were able to increase our long spot holdings to 38.04 SOL with break even price $173.24

Options selling generated $25.87 this week all reinvested back into spot SOL.

Our goal is to gradually grow the fund to 100 SOL. Although we have liquid cash available, we remain cautious about unexpected market moves. The main challenge with SOL options is limited liquidity and a lack of suitable roll dates when positions come under pressure.

All option premium earned this week came from selling put credit spreads expiring January 2, 2026.

Additionally, this week we staked 5 SOL in DeFi. With our break-even price above $173, we decided not to cap part of the portfolio with covered calls. Instead, we’re using staking to generate yield until SOL recovers or until we can improve our break-even level enough to justify writing covered calls again.

TerraM token

Our native TerraM token seems is the only safe haven for the moment, another week held steady at $3.27. Week after week we keep adding more liquidity back to the Raydium liquidity pool, allocating 20% of the TerraM Multi-Asset Fund’s options income to support it.

What else happened this week

This week we moved part of our SOL into Bybit’s bbSOL to generate yield via DeFi-style activities. This remains an experiment, and we don’t yet have a clear, end-to-end understanding of how bbSOL’s yield is produced and what risks (custody, smart-contract exposure, liquidity/peg dynamics, and withdrawal constraints) we’re actually taking.

In parallel, we added put spreads as downside risk mitigation so the portfolio actually benefits if ETH drops further. Put spreads usually require paying a net debit; we financed that cost using a small portion of our weekly options income.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.