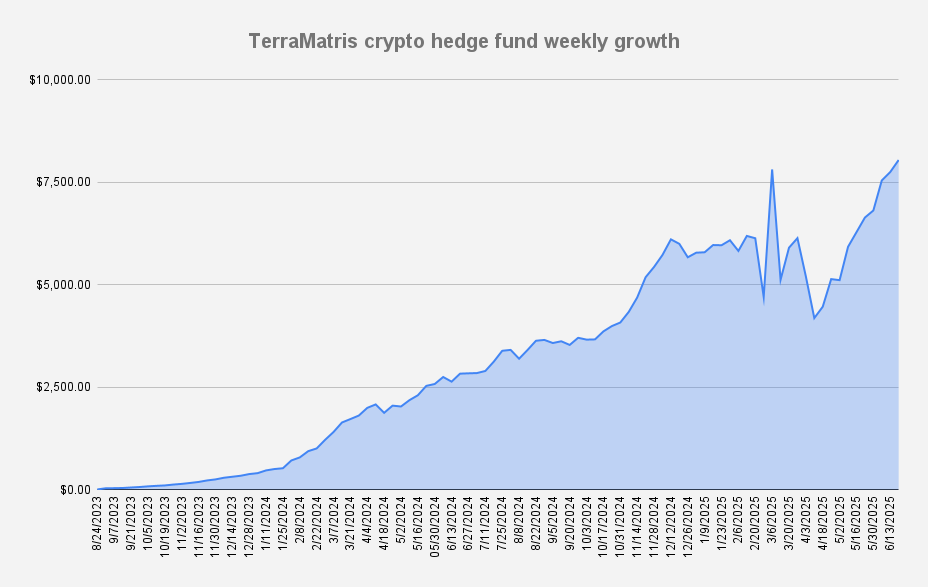

As of June 20, 2025, the Terramatris crypto hedge fund value has grown to $8,045 showing yet another weekly growth of +3.8% or +$294 in dollar terms. Also for the first time since inception we have cracked $8,000 officially, and that mean just one - increased liquidity and buyback for our native TerraM token. More on that bellow

Current Long Perpetual Futures (USDT Settled)

- 0.02 BTC – Break-even: $115,188 | Short puts: $96,000

- 1.9 ETH – Break-even: $3,19 | Short puts: $2,300

- 5 SOL – Break-even: $166.1| Long calls: $158

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $101.02 from options premiums, translating to a 1.25% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

Now with $8,000 officially in our books, our next milestone is to crack $10K. We’re looking at several ways to get there — options premium, crypto appreciation, and possibly raising funds via our native TerraM token. But since options selling is our main source of income, we estimate that even without any additional capital injection and stable market conditions, it would take us about 14 weeks (End of September) to reach $10K.

TerraM Token Update

The TerraM token remains stable at $2.60, with little price movement in recent weeks.

Having just crossed the long-anticipated $8,000 milestone, our fund is taking the next step forward.

We’re adding $75 back into the Raydium liquidity pool by contributing additional TerraM tokens. This move is aimed at reducing slippage and increasing the free float of TerraM in the market.

Additionally, we plan to initiate a modest buyback of TerraM tokens, which should support a price increase by tightening supply. Both the liquidity injection and the buyback are scheduled to be finalized at the beginning of the week.

We anticipate the TerraM token price to rise by approximately 10–13 cents as a result of these actions.

Outreach campaign over LinkedIn

This week, we launched a targeted LinkedIn outreach campaign focused on DeFi, Web3, and crypto investors. We curated a high-potential contact list and reached out to 10 qualified individuals per day, sending warm-up messages to introduce our work and expand awareness of the TerraM fund.

The primary goal is to build credibility and authority within the crypto investment space. A secondary objective is to explore direct or OTC deals involving our fund’s TerraM tokens.

By the end of the week, our CEO had established 164 (+34)LinkedIn connections, while our official company page remained at just 4 followers—a clear signal of the personal nature of early engagement versus brand awareness.

The goal of this outreach campaign is to spark interest, build strategic partnerships, and potentially attract new investments.

If this resonates with you, feel free to connect with us on LinkedIn—we’re always open to meaningful conversations.

Past / Present / Future

Compared to a year ago, our fund has grown by more than 284%, translating to an increase of $5,233. If we can sustain this 284% growth rate over the next 12 months, we could reach a fund value of approximately $22,800. We like that number—and we're focused on getting there.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.