Ep 115: TerraM Multi-Asset Crypto Options Fund Gains +2.42% While Solana Covered Call Slips –1.52%

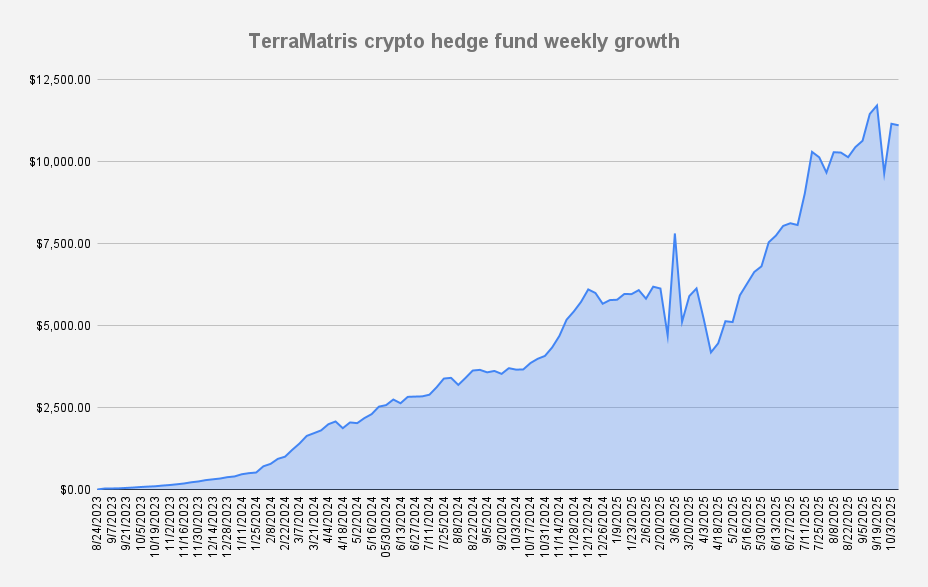

As of October 31, 2025, the TerraM Multi-Asset Crypto Options Fund achieved another week-over-week gain of +2.42%.

As of October 31, 2025, the TerraM Multi-Asset Crypto Options Fund achieved another week-over-week gain of +2.42%.

At Terramatris, we’ve added a small position in Mantle (MNT) to our Multi-Asset Crypto Options Fund, following Bybit’s launch of MNT options. The move aligns perfectly with our focus on assets that support options trading — a key part of our long-term yield strategy.

As of October 24, 2025, the TerraM Multi Asset Crypto Options Fund reported a net asset value of $9,325, showing decent recovery of +7.67% from the previous week.

TerraM Multi-Asset Crypto Options Fund is a closed-end strategy managed by Terramatris LLC, focusing on generating consistent income through systematic options trading on Bitcoin, Ethereum, and Solana.

The fund employs disciplined, rules-based selling of cash-secured puts and covered calls, reinvesting collected premiums into underlying spot positions to steadily compound long-term exposure.

As of October 17, 2025, the TerraM Crypto Fund reported a net asset value of $8,661, representing another massive -22.08% decline from the previous week. This seems to be our biggest drawdown so far in 2025 — let’s hope it stays that way.

When the U.S. government announces new tariffs, markets panic, and crypto tends to take the hardest hit.

We’ve seen this pattern repeatedly: a single policy shock sends stocks tumbling, bonds rallying, and Bitcoin plunging twice as hard. But why does a trade policy aimed at physical goods ripple so violently through digital assets? And how long does it usually take for crypto to recover?

As of October 10, 2025, the TerraM crypto fund value stood at $11,115 what is a slight decrease of -0.42% if compared to the last week.