When the U.S. government announces new tariffs, markets panic, and crypto tends to take the hardest hit.

We’ve seen this pattern repeatedly: a single policy shock sends stocks tumbling, bonds rallying, and Bitcoin plunging twice as hard. But why does a trade policy aimed at physical goods ripple so violently through digital assets? And how long does it usually take for crypto to recover?

Let’s break down the dynamics, the psychology, and what we’ve observed firsthand in our own portfolio after major tariff shocks.

The Immediate Reaction: Panic, Liquidations, and Correlation

Tariff announcements are not just about economics — they’re about uncertainty.

The moment new import taxes or trade restrictions are declared, global investors shift into “risk-off” mode. Equities fall, the dollar spikes, and liquidity evaporates across speculative assets.

Crypto, unfortunately, sits at the very edge of that spectrum.

Within hours of such announcements:

- Bitcoin and Ethereum typically drop 2–3× more than the S&P 500.

- Open interest on futures markets collapses.

- Billions in leveraged long positions are liquidated.

- Volatility (realized and implied) explodes.

In our experience at Terramatris, the portfolio often suffers its sharpest daily drawdowns during tariff headlines — even though the crypto market has no direct link to steel, cars, or semiconductors.

This is purely a sentiment correlation effect: when traditional traders de-risk, they sell everything with volatility attached — and crypto is at the top of that list.

Why Crypto Reacts to Trade Policy at All

There are three main mechanisms behind this correlation:

Risk sentiment transfer

Crypto now trades as a global risk asset. Institutional money, macro funds, and retail traders all treat Bitcoin and Ethereum as high-beta plays on liquidity and optimism. When tariff news signals slower growth or global uncertainty, those positions are first to go.

Liquidity chain effect

Margin calls and equity losses force fund managers to raise cash elsewhere. Crypto holdings — especially on regulated platforms — are often liquidated to meet collateral needs.

Narrative contagion

Even if tariffs don’t touch crypto directly, the macro narrative shifts from “expansion” to “recession risk.” That shift compresses valuations across all risk assets. Algorithms trading cross-asset correlations simply follow the flow.

How Long It Usually Takes to Recover

Looking at previous episodes (2018 China tariffs, 2019 escalation, and smaller tariff scares since), crypto tends to follow a three-phase recovery pattern:

Shock & liquidation

1–3 days

Sharp 10–20 % drops, high funding rates reset, huge volumes

Relief rebound

3–10 days

Oversold bounce, short-covering, funding normalizes

Consolidation & rebuild

2–4 weeks

Range trading before resuming trend, often faster than equities

On average, major tariff-induced crypto crashes take about 2–4 weeks to fully recover, assuming no new escalation.

If tariffs deepen or retaliation follows, recovery can stretch to 6–8 weeks.

Interestingly, crypto often leads the recovery phase — once fear subsides, liquidity returns faster to Bitcoin than to equities. But timing it requires patience and strict risk control.

Our Experience: The March–April Drawdown and September Rebound

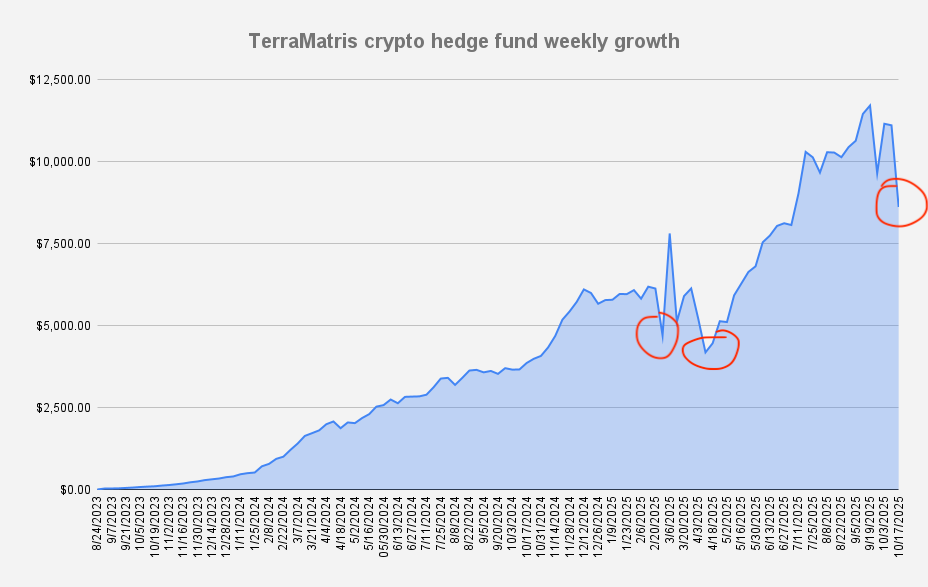

At Terramatris, we experienced a massive portfolio drop during the March–April 2025 correction, triggered by tariff fears and broader macro stress.

The portfolio lost a significant portion of value within days as leveraged long positions across exchanges were liquidated.

However, by staying disciplined — cutting leverage, keeping exposure manageable, and gradually rebuilding — the market fully recovered and went on to reach new all-time highs by September 2025.

That rebound reinforced a critical lesson:

Leverage is the biggest enemy during macro shocks.

Crypto’s volatility is already extreme; adding borrowed exposure magnifies losses exponentially.

Avoiding leverage — or using it sparingly and strategically — is the single best defense against panic-driven wipeouts.

Why Recovery Sometimes Doesn’t Come Quickly

There are reasons recovery may stall or fail entirely:

- Persistent macro fear: If tariffs escalate into a prolonged trade war, investor appetite for high-volatility assets stays low.

- Tight monetary policy: When interest rates remain high, liquidity to fuel speculative rallies dries up.

- Sentiment damage: Multiple shocks in a short period (tariffs + regulation + earnings misses) can exhaust dip buyers.

- Structural leverage wipeouts: After extreme liquidation events, traders need time to rebuild collateral and confidence.

In those cases, the crypto market may move sideways for months even if prices don’t collapse further.

Our Broader Takeaways

Through multiple tariff cycles, we’ve learned three rules that consistently protect capital:

- Keep leverage near zero when macro risk rises.

- Use volatility spikes to sell options or reposition, not to chase price.

- Expect crypto to bottom before equities — but only after forced liquidations clear.

These principles helped us navigate the March–April drawdown and come out stronger in September.

The Takeaway

Tariff announcements are a reminder that crypto is no longer an isolated niche — it’s part of the global macro risk web.

When traditional markets fear slower trade and tighter liquidity, Bitcoin bleeds with the rest of them.

But unlike industrial stocks, crypto tends to snap back faster, provided the policy shock fades instead of festers.

In other words:

“Tariffs don’t target crypto — but crypto still takes the bullet.”

For disciplined investors, that’s both a warning and an opportunity.

When the panic hits, manage risk. When the dust settles, be ready , because crypto rarely stays down for long.