Research

How Crypto Reacts to U.S. Tariff Announcements — and Why It Hurts More Than Stocks

| 74 seen

When the U.S. government announces new tariffs, markets panic, and crypto tends to take the hardest hit.

We’ve seen this pattern repeatedly: a single policy shock sends stocks tumbling, bonds rallying, and Bitcoin plunging twice as hard. But why does a trade policy aimed at physical goods ripple so violently through digital assets? And how long does it usually take for crypto to recover?

Let’s break down the dynamics, the psychology, and what we’ve observed firsthand in our own portfolio after major tariff shocks.

The Immediate Reaction: Panic, Liquidations, and Correlation…

Georgian Tax Residency: A Strategic Option for HNWIs and Crypto Individuals

| 111 seen

At Terramatris, we examine how funds and financial structures work across different jurisdictions. We don’t provide legal or tax advice, but we do explore how certain models stand out in the global landscape. One of the most compelling examples today is Georgia’s tax residency framework, which offers particular advantages to high-net-worth individuals (HNWIs) and crypto investors.

What Is Georgian Tax Residency?The most common path is the 183-day rule:

If you spend at least 183 days in Georgia during a rolling 12-month period, you qualify as a tax resident.There is also a High…

Why Registering a Small Crypto Trading Firm in Georgia Makes Sense

| 45 seen

The global crypto market is becoming more institutionalized, and even small proprietary trading firms need to think about jurisdiction, compliance, and taxation. While the U.S. (Wyoming, Delaware) and offshore hubs (BVI, Seychelles) remain popular, Georgia, the country in the Caucasus,has quietly emerged as an attractive option for crypto-friendly businesses.

Below, we’ll explore why Georgia might make sense for a small crypto trading firm, what the registration process looks like, and the pros and considerations you should keep in mind.

Why Georgia?Crypto-friendly environment…

Discovering Derive: Our First Steps into True DEX Options Trading

| 46 seen

At Terramatris, we’ve always been fascinated by the evolution of crypto markets and the growing range of opportunities they create for traders and investors. For years, our main focus has been on more traditional centralized exchanges (CEX) such as Bybit and Deribit. These platforms have provided liquidity, stability, and advanced trading features—making them indispensable for our operations.

But one thing has always been missing: a true decentralized exchange (DEX) for options trading.

Recently, while researching potential institutional partners for our US operations (Kraken…

Delta-Neutral Arbitrage in Crypto: Inside Terramatris Solana Strategy

| 49 seen

At Terramatris, we are still an early-stage crypto hedge fund. Our core strategy leans toward directional exposure—going long on assets we believe in and applying quantitative options strategies to generate income. Specifically, we sell puts and calls on assets like Ethereum and Solana, capturing option premiums while managing risk.

This allows us to grow the fund more aggressively, as we participate directly in upside movements while securing steady cash flow from option sales.

However, as outside capital gradually flows into the fund, we are also introducing arbitrage…

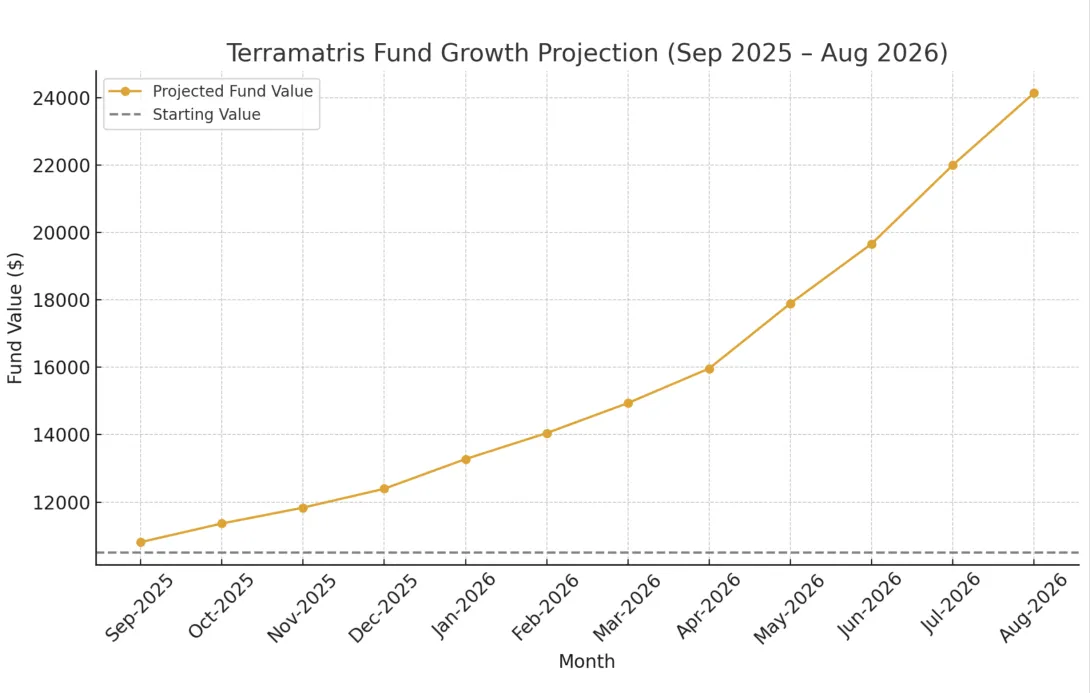

Wishful Thinking, Statistics, and Modeling: Where Could Terramatris Fund Be in September 2026?

| 56 seen

On September 2, 2025, the Terramatris crypto hedge fund stands at $10,500. Out of this, roughly $3,500 is low-interest debt, which we are steadily repaying at a rate of $300–450 per month. If nothing changes, we expect to be debt-free by April 2026. Importantly, there is no real pressure to return these funds quickly; and if market conditions turn against us, we believe we could borrow back on similar terms without risk to the core strategy.

This puts Terramatris in a comfortable position: a five-figure portfolio, a clear debt-repayment path, and a robust options premium strategy…

Snipping in DeFi: Tempting, But Not Sustainable

| 58 seen

At Terramatris, we constantly evaluate emerging strategies in the decentralized finance (DeFi) landscape — especially those that promise asymmetric upside. One such tactic is snipping (or sniping), a method that’s gained attention for its high-speed, high-risk approach to token trading.

We want to offer a clear and honest take: while snipping can be entertaining and, in rare cases, wildly profitable, it doesn’t align with our long-term trading philosophy.

What Is Snipping in DeFi?Snipping refers to the practice of purchasing newly launched tokens at the exact moment liquidity…