On September 2, 2025, the Terramatris crypto hedge fund stands at $10,500. Out of this, roughly $3,500 is low-interest debt, which we are steadily repaying at a rate of $300–450 per month. If nothing changes, we expect to be debt-free by April 2026. Importantly, there is no real pressure to return these funds quickly; and if market conditions turn against us, we believe we could borrow back on similar terms without risk to the core strategy.

This puts Terramatris in a comfortable position: a five-figure portfolio, a clear debt-repayment path, and a robust options premium strategy that has been delivering consistent weekly returns.

The Options Premium Engine

Our core edge comes from selling weekly options—primarily covered calls and short puts.

- Base case (regular weeks): $150 income

- High case (end-of-month weeks): $300 income

This structure mirrors what we saw in August 2025, when August 29 delivered an all-time high $580 in weekly option premium. While that was above our base projections, it demonstrates the upside potential of our systematic approach.

Statistically, this creates a 3–4 regular weeks per month followed by 1 boosted week model. The stability of this rhythm is what makes our growth projections meaningful.

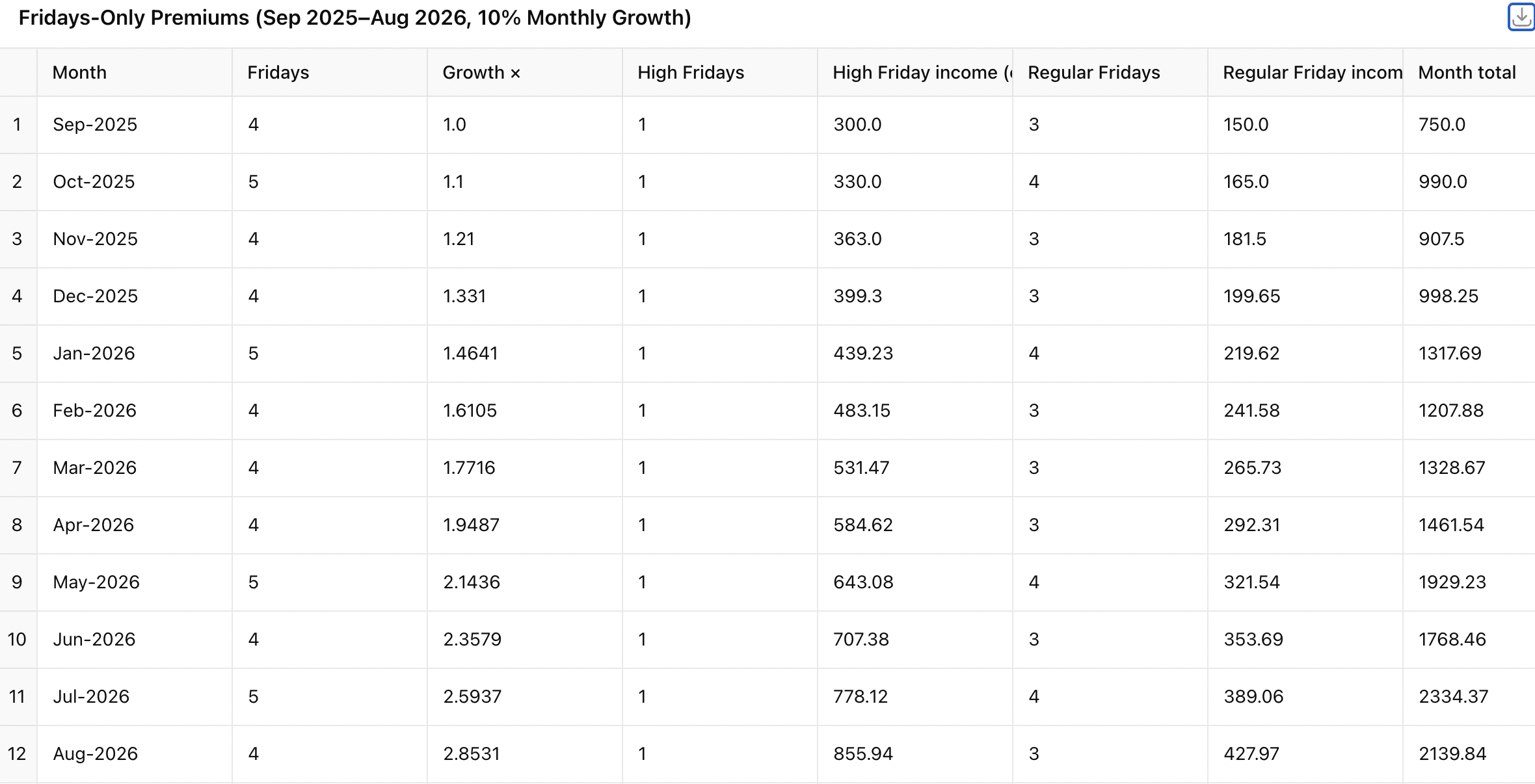

Modeling Forward: A 10% Monthly Growth Scenario

For the year ahead, we assume that options income grows at 10% per month. This is a form of wishful thinking grounded in compounding mathematics:

- Start: September 2025 with $150 regular weeks, $300 high weeks

- Growth: +10% per month on both income types

- Horizon: 12 months (September 2025 – August 2026)

Using this model with the actual Friday distribution, Terramatris is projected to generate about:

- $17,133 total in options premiums from Sept 2025 → Aug 2026.

This compares to $9,600 in a linear, no-growth scenario—showing how much impact compounding can have if we keep executing consistently.

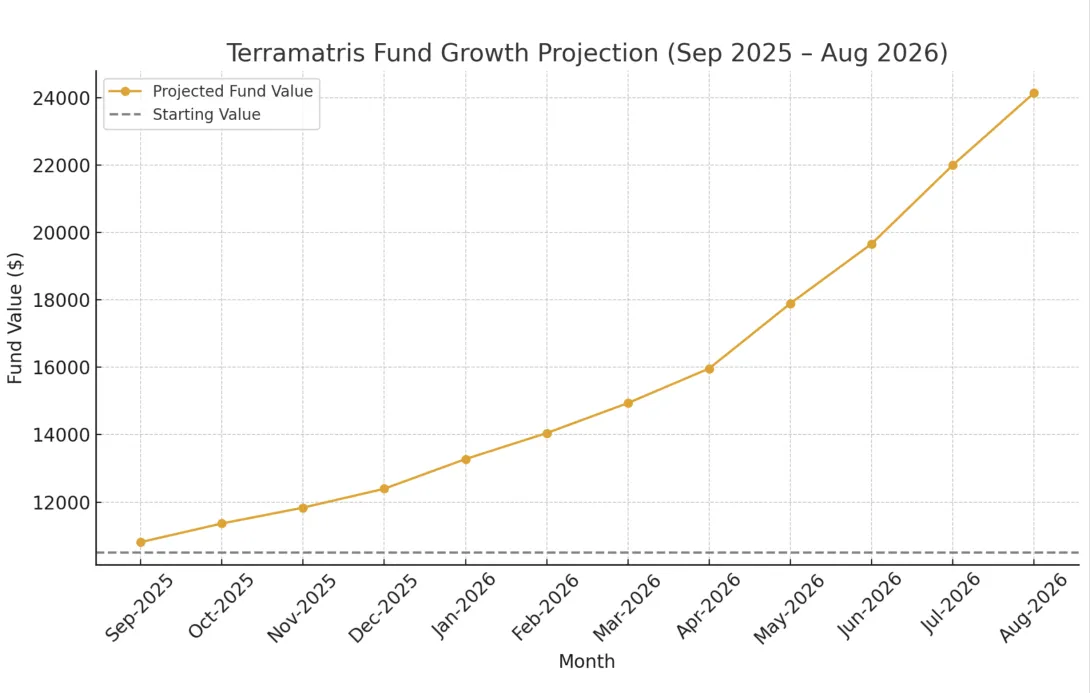

Fund Value by September 2026

Let’s combine these flows:

- Starting value (Sept 2025): $10,500

- Debt repayment by April 2026: ~($3,500) returned gradually

- Options income (1 year): +$17,133

If all premiums are reinvested and debt fully cleared by spring, the fund value in September 2026 could stand around $24,000.

That’s more than +128% growth year-over-year. Even with more conservative assumptions (say 5–6% monthly growth, or stagnant summer markets), the projection shows healthy double-digit compounding.

The TerraM Token Effect

The TerraM token is designed to reflect the performance and value of the Terramatris fund. If the fund nearly doubles in size, the token’s intrinsic backing strengthens:

- More collateral per token

- More confidence in future buybacks and liquidity

- Stronger long-term sustainability

While the crypto markets are volatile and nothing is guaranteed, a growing base fund value directly improves the TerraM token’s story. It makes the token not just a speculative asset, but a reflection of real trading income.

A Note on Wishful Thinking

All projections are based on statistics and models. Reality can diverge:

- Option premiums may dip in quiet months

- Market drawdowns may force adjustments

- Growth may not compound as neatly as modeled

That’s why we emphasize monthly reviews. Each month, we can re-test assumptions and adjust premium targets. But as a starting point, the 10% growth model provides a compelling roadmap of what’s possible.

Conclusion

By September 2026, if Terramatris executes consistently, clears its small debt, and keeps compounding weekly premiums, we could be looking at a fund size above $24,000. The journey from a $10,500 base to this level in 12 months shows how disciplined option selling and compounding growth can transform a small fund into a serious player.

Wishful thinking? Perhaps. But with math, modeling, and momentum on our side, it’s a future worth striving for.