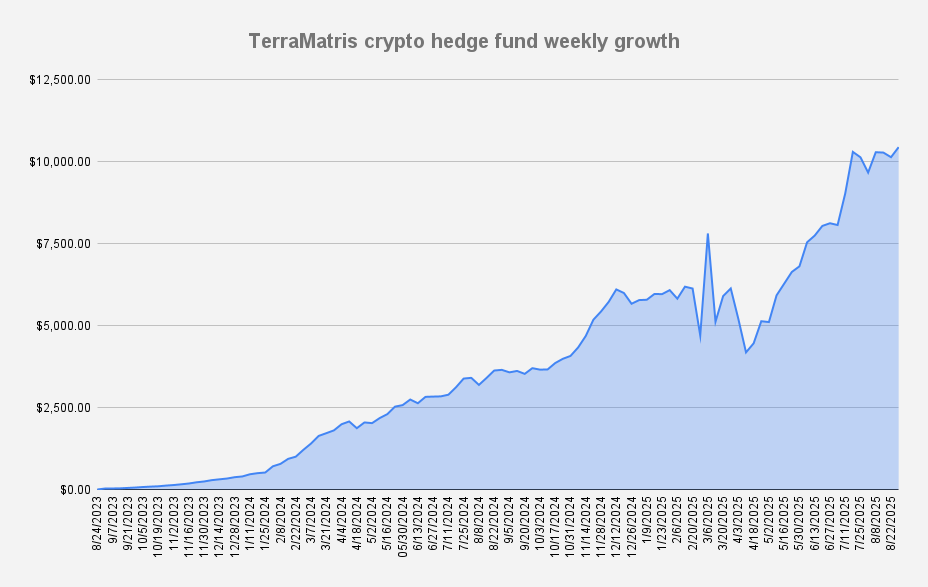

As of August 29, 2025, the Terramatris crypto hedge fund value stood at $10,448 what is an increase of +3.02% or +$306 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

Just like the previous week, this one was also marked by significant volatility. Ethereum (our bread and butter) surged to nearly $5,000 — a new all-time high — before pulling back to $4,360at the time of writing. We believe that if ETH breaks above $5,000, another major rally could follow — perhaps toward $7,000? That’s just speculation, of course. Nevertheless, as put sellers, we always remain cautious while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +83.97%.

Current Long Perpetual Futures (USDT Settled)

- 1.6 ETH – Break-even: $4,984 | Short puts: $4,150

- 13 SOL – Break-even: $202.73 | short puts: $190

We bought back 0.1 ETH and added it to our long positions. Additionally, this week we initiated a new strategy with Bitcoin perpetual futures, aiming to sell covered calls against them. We are starting small with 0.01 BTC and plan to gradually increase our exposure to 0.1 BTC over the next 10 weeks.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $582 from options premiums, translating to a 5.57% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

This has been our best-performing week so far in terms of yield and options premium.

To be precise, the surge was driven by the rollout of monthly expiry options. We consistently observe a premium boost at the end of each month as we simultaneously roll forward both weekly and monthly positions.

Additionally, it should be noted that we rolled forward and up some in-the-money options which remain in-the-money after this rollout. As a result, the reported options income premium has been skewed by approximately $160 this week.

Looking ahead, we do not expect to exceed $200 per week in options premiums until the final week of September. For now, we have set a baseline target of $150 per week throughout the month.

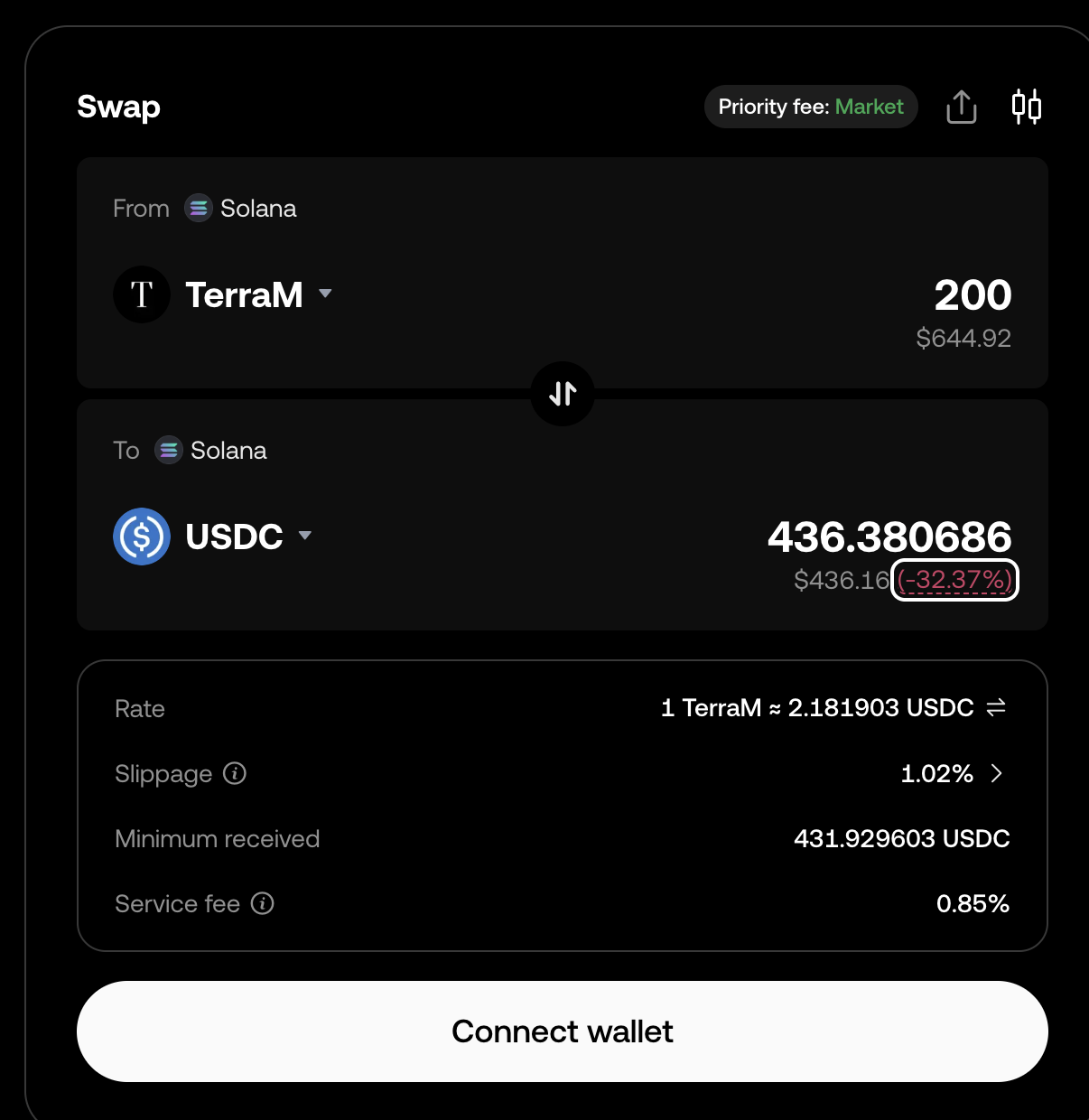

TerraM token

Last week, we onboarded another OTC purchase by bringing in fresh capital. We are grateful to our long-time associate Rob for this referral and remain committed to delivering excellent results in the future. Besides that there hasn’t been much movement with our native TerraM utility token last week. We anticipate initiating treasury operations once the fund’s value reaches $12,000.

- Solana blockchain

- Fully Diluted Market cap: $32,600

- Total supply: 10,000

- In circulation: 1,681 (16.81%)

- On Liquidity pool: 410 (4.10%)

- Price per token: $3.26

- Slippage per 200 TerraM tokens (-32.37%)*

*The biggest challenge we are currently facing with the TerraM token is slippage. Due to the shallow depth of the liquidity pool, slippage remains significant — for example, converting 200 TerraM back to USDC would currently incur a loss of -32.37%. We expect to reduce slippage by a few percentage points once the fund’s value surpasses $12,000.

Terramatris LLC may, from time to time, repurchase $TERRAM tokens from the open market for purposes such as liquidity pool management, ecosystem initiatives, or treasury operations. These activities are not intended as investment incentives and do not guarantee any future token value.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions