On January 16, 2026, the TerraM token traded at $2.69. Trading activity remained modest, with transactions skewed mostly toward buys. During the week, we also added liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 1.35% of total supply bringing our total market cap to $26,900.

Slippage remains elevated due to shallow liquidity. This is not ignored—we are actively working on liquidity depth, pool balance, and execution efficiency as part of the broader TerraM token mechanics.

Our CEO announced his intention to initiate a 52-week TerraM buyback challenge. If executed consistently, this could result in him personally holding up to ~5% of the TerraM token supply over the course of a year.

TerraM Multi Asset Fund

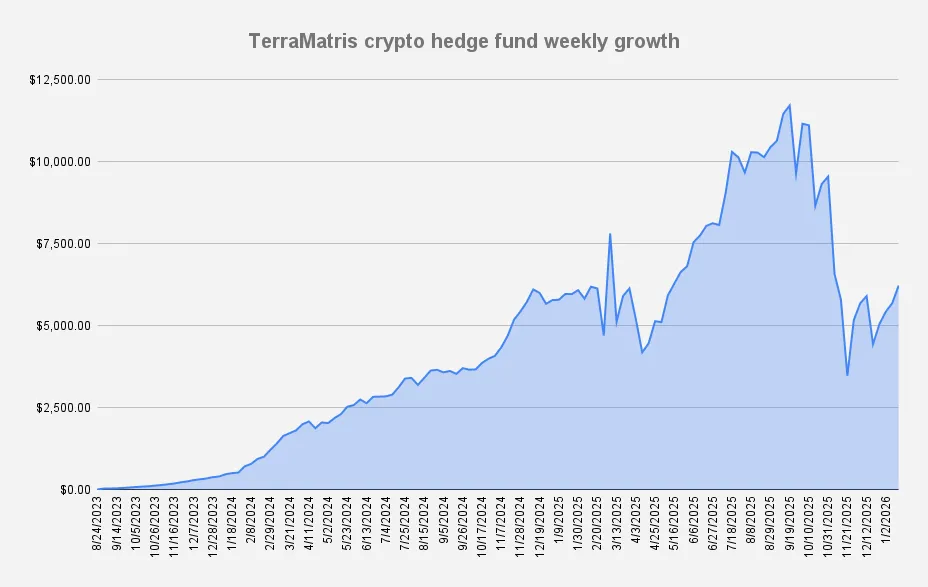

TerraM Multi-Asset Crypto Options Fund is up 9.45% week-over-week, marking another week of gains in 2026.

TerraM Multi-Assets Fund drawdown from all time high back in September 2025 is –46.88%. While YTD fund is up 15.6%, slightly outperforming Bitcoin (+9.41%) and ETH (+11.50%).

We operate much like $MSTR: strong performance in bull markets, but disproportionately impacted during bear markets. This week, we took a closer look at why many investors prefer $MSTR over directly holding BTC. It’s an interesting dynamic. Our thoughts here: Why Invest in MicroStrategy (MSTR) When You Can Buy Bitcoin Directly?

Fund generated $207 in options premiums, what is impressive 3.34% weekly return on capital. This week, we again flipped our perpetual futures exposure and rotated from calls to puts, as the previous call options expired in the money. While this is not an ideal setup if ETH continues to rally, the positions remain income-generating and we continue to get paid.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Strike |

|---|---|---|---|

| ETH | 2.8 ETH | $3,453 | $3,200 (puts) |

| SOL | 16 SOL | $183.11 | $138 (puts) |

| BTC | 0.02 BTC | $105,978 | $95,000 |

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

We didn’t convert perps to spot this week, because we’re also prioritizing a reduction in our margin debt, which currently stands at -1,774 USDT (as of today). If we can consistently set aside $207 per week, we’ll eliminate our margin debt in about 8-9 weeks.

Additionally this week, we decided to unwind part of the SOL exposure by rotating it into ETH. We closed 3 SOL positions and opened an additional 0.1 ETH, keeping the same break-even models. The plan is to gradually exit SOL entirely from adjustment trades, as SOL exposure is already handled separately in the dedicated Solana covered call fund (more on that below).

Solana Covered Call Growth Fund

Solana Covered Call Growth Fund climbed for the forth week in a row by additional +2.96%, increasing the NAV per unit to $0.79. At the end of week we were able to increase our long spot holdings to 43.28 SOL with break even price $168.15

Options selling generated $54.97 this week all reinvested back into spot SOL.

Our goal is to gradually grow the fund to 100 SOL. Although we have liquid cash available, we remain cautious about unexpected market moves. The main challenge with SOL options is limited liquidity and a lack of suitable roll dates when positions come under pressure.

All option premium earned this week came from selling cash secured put options, expiring February 27, 2026.

The bottom line

The broader crypto market appears positioned for a constructive move, provided this is not a bear trap. Our philosophy prioritizes investing over short-term trading; positions are managed tightly, but we are not overly concerned about short-term direction - though, naturally, a bullish outcome is preferred.