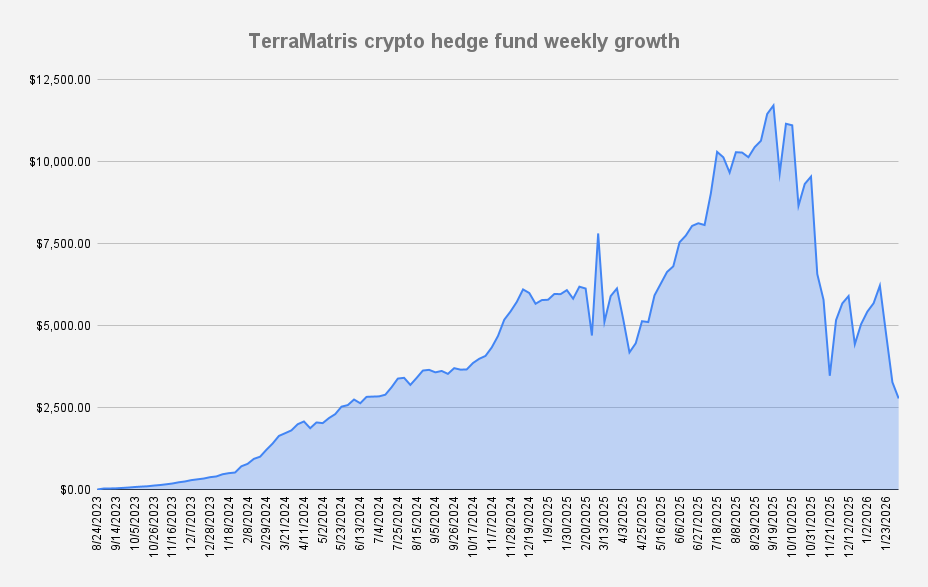

This week marked one of the most difficult moments in Terramatris’ history. The crypto market experienced a sharp and disorderly sell-off, and our portfolio entered what can only be described as a leverage-driven death spiral. At the peak of exposure, we were effectively controlling roughly 6 ETH with an average entry price above $3,500. Most of this exposure was expressed through perpetual futures and short put options, both of which moved deeply underwater as ETH collapsed. When Ethereum dipped below $2,000, the math stopped working.

At that point, we made a hard but necessary decision: unwind, realize losses, and move forward. We do not know whether this is the market bottom, nor whether a sharp recovery could follow quickly. What we do know is that continuing to operate under forced leverage would have turned volatility into a permanent constraint. We are comfortable accepting this reset.

This week, Terramatris capitulated.

We deliberately closed all leveraged positions, accepted the drawdown, and reset the portfolio structure. This was not an emotional reaction. It was a risk decision driven by deteriorating market conditions, expanding volatility, and the simple reality that leverage ceases to be a tool once it starts dictating behavior.

TerraM Token

On February 6, 2026, the TerraM token traded at $1.77, down -37.45% week over week. The magnitude of the drop was largely due to shallow liquidity. Two relatively small trades — swapping a combined 50 TerraM tokens and removing roughly 100 USDC from the pool - caused a disproportionate price impact.

Liquidity has since increased, and we continue to view this as constructive over the long term. Our strategy remains unchanged: add liquidity weekly during profitable periods and conduct buybacks when conditions allow. Over time, deeper liquidity should reduce volatility and improve market structure, though price recovery may take time.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.83% of total supply. As a result, total market capitalization now stands at approximately $17,700, down $10,600 week over week.

Our broader objective remains expanding liquidity coverage to 10%, with the next milestone being 3%. We expect to cross that threshold within the next one to two weeks. Until liquidity deepens further, slippage will remain elevated.

Ethereum Strategy

As we transition to a spot-Ethereum-only structure, we have renamed the TerraM Multi-Asset Fund to reflect this change more accurately. Going forward, it will operate as the TerraM Ethereum Strategy.

For the third consecutive week, the fund recorded a sharp decline, falling -15.11% week over week. While it may still be premature to declare full market capitulation at the macro level, our own actions clearly reflect a capitulation phase. We exited the majority of leveraged exposure, realized substantial losses, and liquidated altcoin positions at a loss in order to remain solvent and prevent further forced deleveraging.

Some leverage remains, in form of margin debt, but its rapid reduction is now the top priority. At this stage of the cycle, survival outweighs any attempt at optimization.

The strategy is now deliberately simpler and more defensive. Exposure is limited to spot ETH only, with yield generation focused primarily on covered call selling. Put selling will be used selectively and only when position sizing and risk conditions are unequivocally favorable.

From the all-time high in September 2025, the fund is down -76.26%. We will use this as our new medium - long term benchmark. Year-to-date performance stands at -48.32%, materially underperforming ETH itself, which is down -34.44% over the same period.

There is, however, a clear operational positive. During the week, the ETH Strategy generated $220 in options premiums, reducing the effective ETH break-even price to $1,873. By week’s end, the strategy held 2.025ETH with an average acquisition price of $1,982.

Solana Covered Call Growth Fund

The Solana Covered Call Growth Fund was not spared from the broader sell-off, declining -28.74% on the week and closing with a NAV per unit of $0.48.

By week’s end, we were able to increase long spot holdings to 49.29 SOL, with a break-even price of $154.73.

No options premiums were earned during the week.

It is worth noting that, unlike the ETH strategy, no leverage was ever used in the Solana fund. Even so, a weekly drop of approximately 29% in SOL leaves little room for optimism in the near term. Still, perspective matters. We remember 2022, when SOL traded below $10.

What Changed Structurally

All leveraged positions have been closed. Remaining cash, combined with a small amount of margin, was used to purchase 2 ETH. These ETH are now used exclusively for selling covered calls. There is no naked exposure and no directional leverage.

The short-term objective is clear and non-negotiable: eliminate margin debt entirely while maintaining long ETH exposure.

This structure allows us to generate steady option income, reduce debt mechanically, and remain invested without leverage risk.

Despite the reset, the strategy is already functioning as intended. Options premiums earned this week totaled $220. This income is directed exclusively toward margin reduction. There is no reinvestment and no compounding. This phase is about balance-sheet repair.

Accepting Reality

We also made a difficult internal decision regarding the TerraM token. Allowing the price to fall to $1.77 - levels not seen since late 2024 - was not taken lightly. Total market capitalization declined to approximately $17.7K.

Maintaining artificial price levels during a broad crypto sell-off would have been dishonest and unsustainable. With both Bitcoin and Ethereum under pressure, this repricing reflects reality, not failure. We accept it.

This reset did not happen in isolation. Crypto markets are correcting sharply, volatility has expanded, and leverage is being punished across the board. Under these conditions, survival and optionality matter more than aggressive positioning.

There will be no attempt to win back losses quickly. No revenge trading. No backward-looking justification.

From here, the policy is straightforward: spot-only exposure, covered calls for income, and no leverage-driven strategies. Options will be used to generate cash flow, not to speculate.

Capitulation is not defeat. It is recognition.

Terramatris remains operational, solvent, and focused. The portfolio is simpler, more robust, and aligned with current market realities.

We do not look back. We rebuild from here - slowly, mechanically, and without leverage.