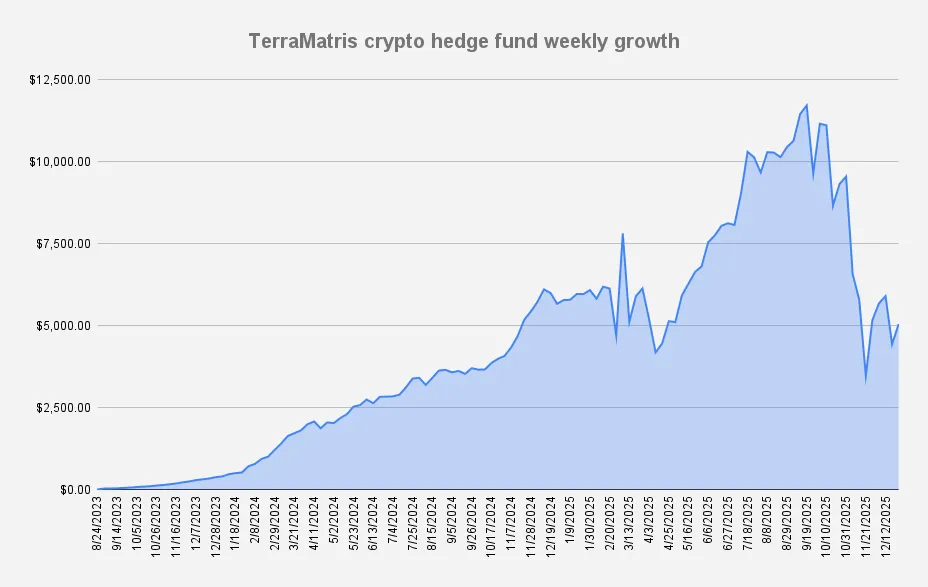

As of December 26, 2025, the TerraM Multi-Asset Crypto Options Fund is up +13.77% week-over-week, encouraging result after previous weeks sharp drop. With only a few days left in 2025, crypto appears to be searching for a footing as it heads into 2026.

TerraM Multi-Assets Fund drawdown from all time high back in September is –56%. While Year-to-date, our Fund is down –11.12%, underperforming Bitcoin (–4.57%) and ETH (–10.59%).

Options Income

This week, the TerraM Multi-Asset Fund generated $276 in options premiums, what is impressive 5.4% weekly return on capital. The increase in options income comes from selling in-the-money covered calls below our breakeven, which raises premium income but caps upside. On the positive side, we continue selling below breakeven and are now rapidly approaching breakeven, at least for Ethereum.

This week, we also purchased put and call options expiring next week to improve portfolio hedging against both downside and upside moves.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Long Calls |

|---|---|---|---|

| ETH | 2.8 ETH | $3,382 | $3,000 |

| SOL | 19 SOL | $183.55 | $132 |

| BTC | 0.02 BTC | $108,190 | $93,000 |

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

We didn’t convert perps to spot this week, because we’re also prioritizing a reduction in our margin debt, which currently stands at -2,990 USDT (as of today). If we can consistently set aside $276 per week, we’ll eliminate our margin debt in about 10 weeks.

Solana Covered Call Growth Fund

Solana Covered Call Growth Fund climber bit by +0.9%, keep the NAV per unit flat at $0.71. At the end of week we were able to increase our long spot holdings to 39.43 SOL with break even price $171.30

Options selling generated $49.43 this week all reinvested back into spot SOL.

Our goal is to gradually grow the fund to 100 SOL. Although we have liquid cash available, we remain cautious about unexpected market moves. The main challenge with SOL options is limited liquidity and a lack of suitable roll dates when positions come under pressure.

All option premium earned this week came from selling covered calls expiring January 30, 2026.

TerraM token

Our native TerraM token for another week held steady at $3.27. Week after week we keep adding more liquidity back to the Raydium liquidity pool, allocating 20% of the TerraM Multi-Asset Fund’s options income to support it.

The bottom line

In short, this was another strong week: we generated solid income, improved our breakeven levels, and are well positioned for a strong start to 2026.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.