On January 30, 2026, the TerraM token traded at $2.83, up 2.9% week over week. Trading activity increased following the launch of a 1 TerraM token weekly reward for liquidity staking. Automated trading bots quickly identified the incentive and began purchasing and staking TerraM tokens.

For most of the week, TerraM traded tightly around $2.90, before slipping to $2.83 on Friday morning amid short-term profit-taking by trading bots.

This bot trading development is positive. We estimate that 70–90% of DeFi activity is bot-driven, and as long as these bots are deploying real capital, their participation improves liquidity and market efficiency.

Bots, Rewards, and TerraM: Unexpected Signals from DeFi Liquidity

Looking ahead, we plan to continue using staking rewards as a tool to sustain and grow TerraM trading volume. During the week, we also added liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 1.62% of total supply. As a result, total market capitalization rose to approximately $28,300, an increase of $800 if compared to the previous week

Our larger objective is to expand the liquidity pool to 10%, but the next key milestone is getting past 2%. We anticipate achieving this within 3–4 weeks. Until liquidity improves, slippage will continue to be significant.

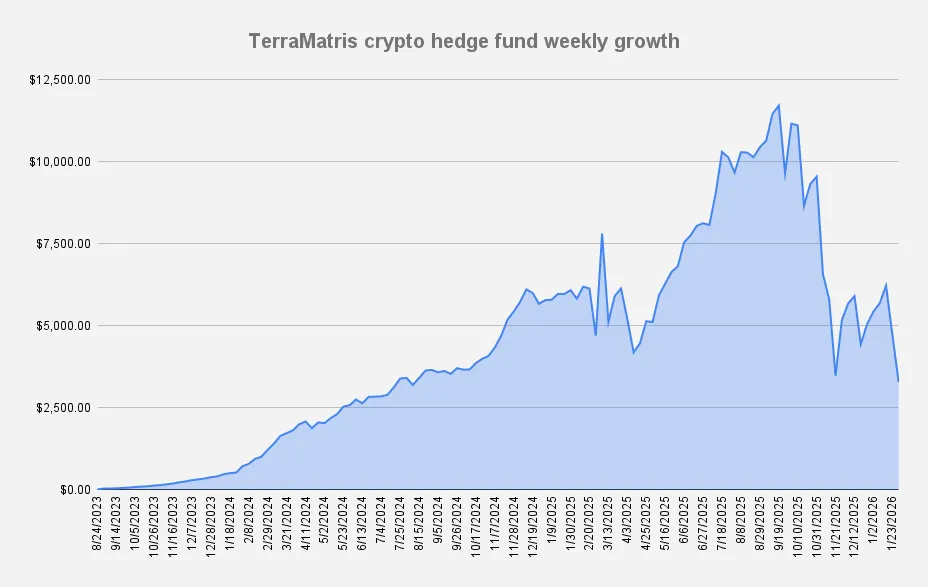

TerraM Multi Asset Fund

Things were far less smooth for the TerraM Multi-Asset Crypto Options Fund, which suffered another -30.84% week-over-week drop - the second massive decline in a row. While we’d like to call this market capitulation, we’re not ruling out more pain ahead.

Funds drawdown from all time high back in September 2025 is –72.03%. While YTD fund is down -39.12%, underperforming Bitcoin (-5.49%) and ETH (-8.41%).

On the bright side fund generated $202 in options premiums, representing an impressive 6.16% weekly return on capital. This return, however, comes with a trade-off: we are selling in-the-money (ITM) covered calls. As a result, the strategy may underperform in the event of a strong market recovery - a classic limitation of covered call strategies.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Strike |

|---|---|---|---|

| ETH | 2.7 ETH | $3,358 | $2,850 (0.3); $2,900 (0.8); $3,000 (0.8); $3,100 (0.8) |

| SOL | 13 SOL | $181.08 | $122 |

| BTC | 0.02 BTC | $104,953 | $88,000 |

Due to the massive selloff, we decided to split our 2.7 ETH position across four different February expiries, selling calls at multiple strikes. This approach may come with trade-offs: higher execution costs and potentially lower premiums in the coming weeks, as we will have fewer contracts to roll next week. However, if the market recovers, our upside will be less capped, and future rollouts should be smoother.

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

This week, we converted 0.1 ETH to spot, increasing our long spot position to 1.4 ETH. Unfortunately, this adjustment came at a cost, increasing our margin debt to approximately –3,940 USDT. With weekly premium of $202 per week, we expect to fully eliminate the margin debt within the next 20 weeks.

Margin debt also increased significantly as the underlying assets sold off sharply — a direct consequence of trading with leverage.

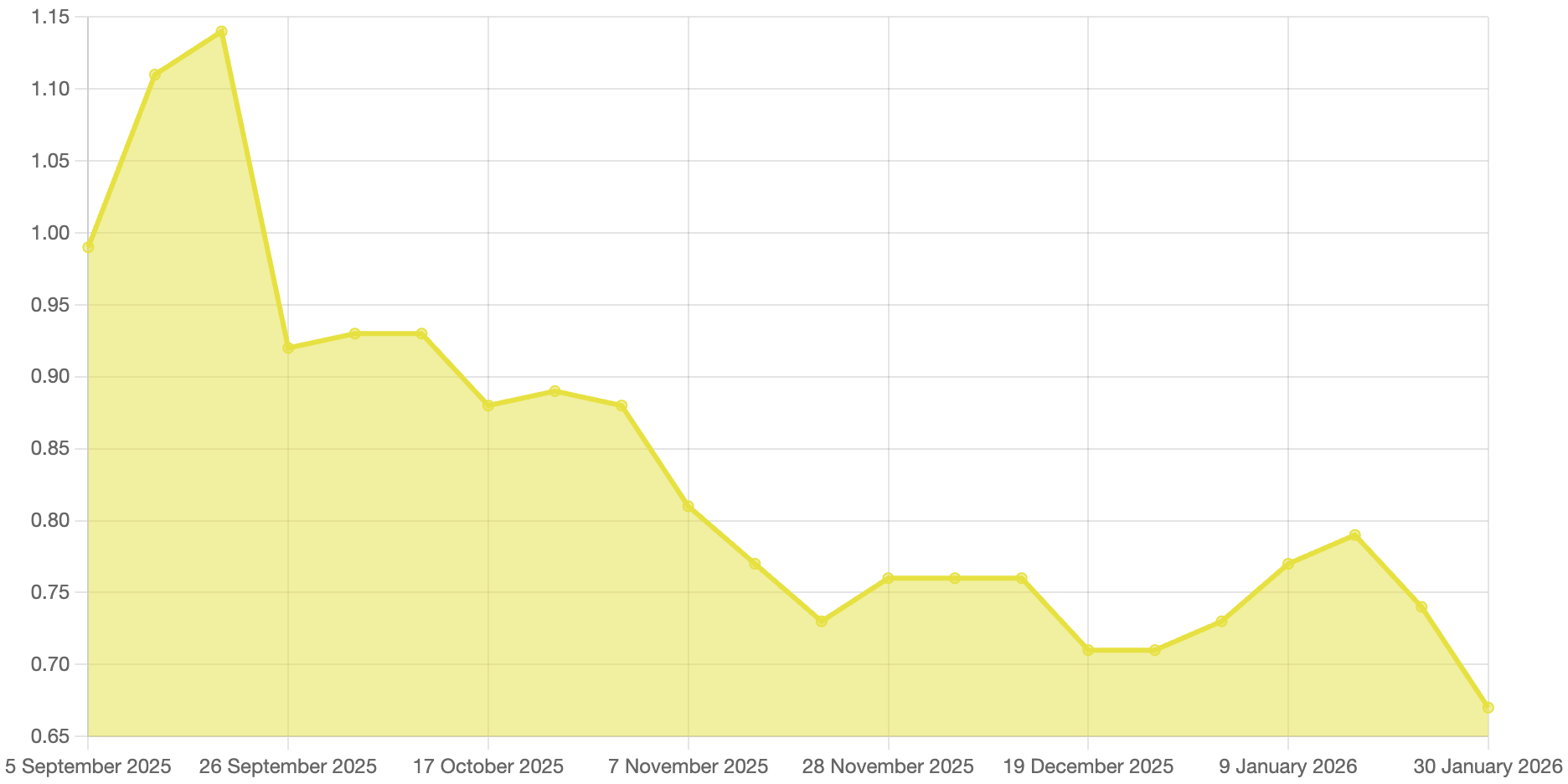

Solana Covered Call Growth Fund

Unfortunately also Solana Covered Call Growth Fund experienced a drop of -9.22%, closing week with NAV per unit at $0.67. While at the end of week we were able to increase our long spot holdings to 48.29 SOL with break even price $156.97.

Options selling generated $96.84 this week all reinvested back into spot SOL.

For now on, we have decided to switch to monthly options trading on Solana. The rationale is straightforward: compared to ETH and BTC, Solana has significantly less liquidity and fewer available expiry dates, which makes weekly trade adjustments relatively ineffective.

All option premium earned this week came from selling covered call options, expiring February 27, 2026.

Bottom line:

We’re genuinely thrilled that TerraM managed to grow despite the massive crypto market selloff. Even though trading bots quickly spotted the new staking incentive and increased activity, they weren’t able to meaningfully influence the price — TerraM held up well under pressure.

That said, the broader market pain is real and it does hurt the portfolio long-term. In the coming weeks, we expect lower option premiums as volatility cools down after this purge — but if that’s the “cost” of surviving a market-wide leverage wipeout, we’re happy to pay it.

Looking forward, we remain cautiously optimistic: with a lot of leverage flushed out, the market could see renewed buy pressure. Still, we are not excluding further downside, including ETH potentially dropping toward $2,500 — and we sincerely hope we’re wrong. Since we also use leverage, we’re not excited about that scenario. But for those of you who avoid leverage at all costs: you’ll be fine.