SOL

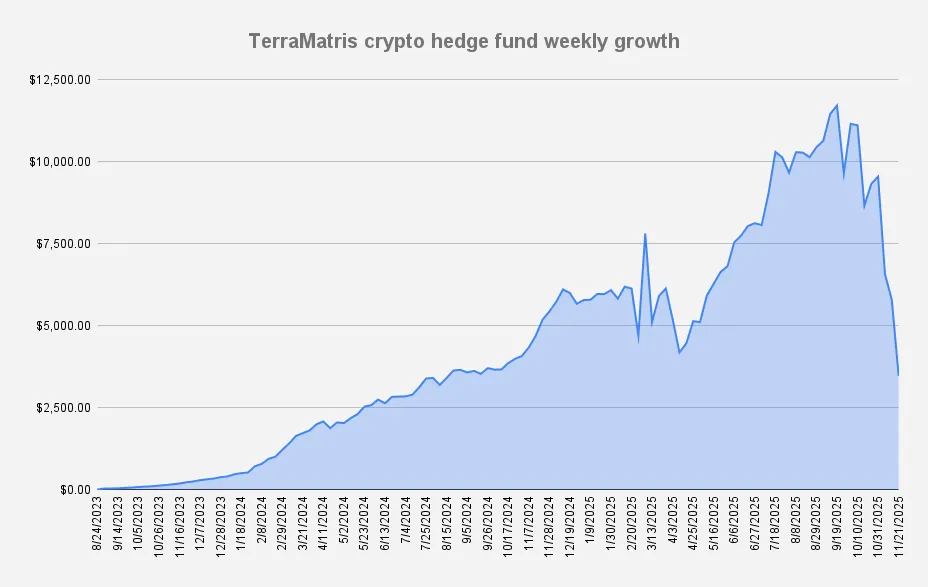

Ep 118: TerraM Fund Reports Record –40% Weekly Loss as Drawdown Reaches –70%

| 97 seen

As of November 21, 2025, the TerraM Multi-Asset Crypto Options Fund is down –40.00% week-over-week, marking our worst weekly result to date. The overall drawdown has deepened to –70.35%, placing the fund firmly in distressed territory. The crypto bear market has hit us hard, and leverage remains the primary problem. Core positions are still intact, but another week of similar magnitude could put us at serious risk without additional external capital.

Last week’s outlook turned out correct: BTC slipped toward the previously noted $84,000 level. While we’re not issuing price…

Episode 107 / Fund Grows 1.86% | New Solana Covered Call Fund & JUP Staking

| 82 seen

As of September 5, 2025, the Terramatris crypto hedge fund value stood at $10,643 what is an increase of +1.86% or +$194 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

The past week started with some active moves — we even adjusted one ETH position by rolling it down and forward. However, as the days progressed, market activity slowed, and the week ended relatively calm, with little movement in crypto markets.

At this point, we might be entering a consolidation phase, setting the stage for a binary outcome — either the start of…

Episode 85 / Crypto Hedge Fund Plummets 34.18% in March 2025

| 205 seen

The Terramatris crypto hedge fund endured a punishing March, with brief recoveries eclipsed by a dramatic late-month collapse. As of March 31, 2025, the fund’s value stood at $5,142, reflecting a steep -34.18% drop month-over-month. Year-to-date, our fund is down -9.45%, underscoring the relentless challenges we’ve faced.

March 2025 has been a grueling period for Terramatris, with our performance trailing major cryptocurrencies.

Bitcoin (BTC) ended the month down -2.98%, a modest decline compared to our -34.18% plunge.Ethereum (ETH), a core holding, fell -17.39%, magnifying our…Episode 84 / Crypto Hedge Fund Grows 3.95% to $6,138

| 64 seen

The Terramatris crypto hedge fund has continued its upward trajectory this week.

As of March 27, 2025, the fund’s value has increased to $6,138, reflecting a 3.95% week-over-week growth (or +$233 in dollar terms). This follows last week’s significant rebound, where the fund grew to $5,904—a 15.31% gain. Despite these gains, we remain -21.46% below our all-time high of $7,811, recorded on March 6, 2025, underscoring the broader market’s persistent volatility.

This week’s recovery comes amid a fragile but stabilizing crypto market. Ethereum, our most impacted position, has…

Episode 83 / Crypto Hedge Fund Sees 15.31% Growth, Reaching $5,904

| 41 seen

The Terramatris crypto hedge fund has rebounded significantly this week, with the fund’s value increasing to $5,904, representing a 15.31% gain compared to the previous week. However, the drawdown from the all-time high still stands at -24.44%, reflecting the broader market’s ongoing volatility.

This recovery follows a highly turbulent period, during which Ethereum dipped below $2,000, triggering forced liquidations and widespread panic selling. As of now, market sentiment remains fragile, but some relief rallies have taken place and Ethereum (our most suffered position, has climbed…