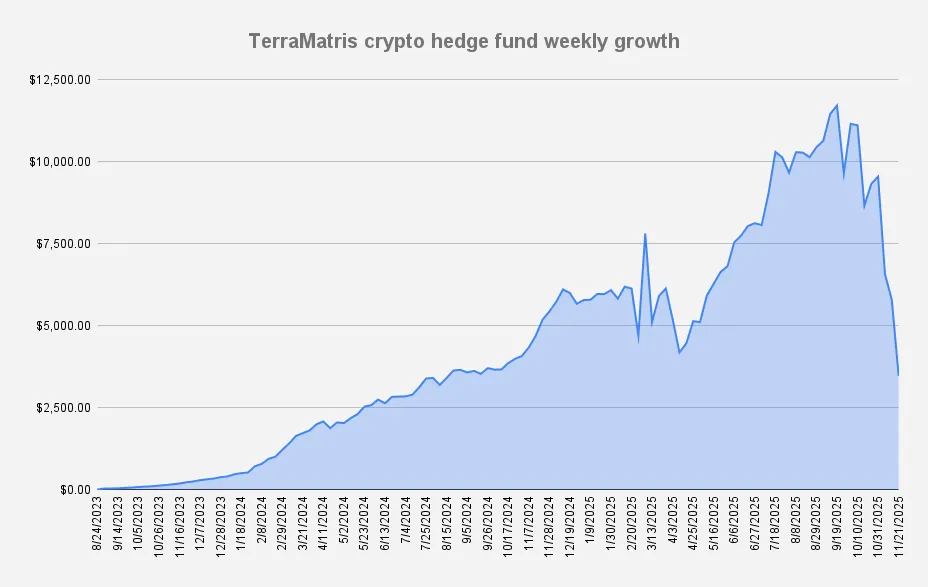

As of November 21, 2025, the TerraM Multi-Asset Crypto Options Fund is down –40.00% week-over-week, marking our worst weekly result to date. The overall drawdown has deepened to –70.35%, placing the fund firmly in distressed territory. The crypto bear market has hit us hard, and leverage remains the primary problem. Core positions are still intact, but another week of similar magnitude could put us at serious risk without additional external capital.

Last week’s outlook turned out correct: BTC slipped toward the previously noted $84,000 level. While we’re not issuing price predictions, a short-term bounce — potentially a long-anticipated Santa rally — is still possible. Conversely, a push down toward $75,000 cannot be dismissed. Technical patterns typically revert, making a recovery toward the $95,000 area plausible, though far from guaranteed.

Bitcoin is clearly oversold. It’s trading below both its 50- and 200-day moving averages, and a death cross has already occurred. The RSI is deep in oversold territory. A further decline is still possible, but from a technical standpoint, a bounce (even if short-lived) is likely.

The central issue remains leverage. Without it, the portfolio would absorb volatility more gradually. With it, losses accelerate — a dynamic perfectly captured by Buffett’s line: markets climb the stairs but take the elevator down. That’s an accurate description of the past few weeks.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, the TerraM Multi-Asset Fund generated $102 in options premiums, what is impressive 2.9% weekly return on capital.

For the sake of transparency, the options income comes with certain trade-offs. We sold covered calls below our break-even levels. This means that if the market experiences a strong rally, we may forgo part of the upside potential.

Trades and Adjustments (USDT Settled / Weekly)

- 1.29 ETH – Break-even: $4,069 | Long calls: $2,900 (0.59), $3,800 (0.2) $4,200 (0.4) | Short put: $3,800 (0.1)

- 13 SOL – Break-even: $201.71 | Long calls: $145

- 0.02 BTC – Break-even: $112,250 | Long calls: $92,000

Solana Covered Call Growth Fund

Our open-ended Solana Covered Call Growth Fund also followed downtrend, but not as massive, declining by just -4.7%, with the NAV per unit now at $0.73. The fund operates without leverage, so the drawdown poses no structural risk — we simply ride out the market move. Additionally we are already holding 31.18 SOL with break even price $178.9

Options selling generated $31 this week all reinvested into spot SOL

TerraM token

our native TerraM token also was not an exception and dropped it value to $2.87

The Bottom Line

The fund suffered its steepest weekly decline on record, with a –40% drop and an overall –70.35% drawdown, driven primarily by leverage exposure during a deepening crypto bear market. Core positions remain intact, but another similar shock could become critical without fresh capital. BTC moved as expected toward $84,000, and while a bounce or seasonal rally is possible, further downside toward $75,000 cannot be ruled out. Technical mean reversion suggests a potential recovery toward $95,000, but uncertainty remains high.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.