Greetings, fellow investors and enthusiasts of TerraMatris! I'm Reinis Fischer, the CEO and founder of TerraMatris Crypto Hedge Fund, bringing you our weekly insights and updates from the dynamic world of cryptocurrency investments. Today, on March 21st, 2024, I'm pleased to provide a comprehensive overview of our recent activities, strategies, and market analysis.

Before delving into the specifics, let me offer a brief introduction to TerraMatris. We are a private crypto investment hedge fund, managed by yours truly, Reinis Fischer. Operating primarily from Georgia, our fund is privately held and specializes in leveraging decentralized liquidity pools for optimal investment outcomes.

A Step-by-Step Guide to Buying TerraM Tokens via Raydium AMM

At TerraMatris, our trading strategy revolves around astute options trading on prominent cryptocurrencies like Bitcoin and Ethereum. We focus on high-probability trades, leveraging put options on Bitcoin and occasionally selling call options on long Ethereum futures. Our approach involves meticulous risk management, with a keen eye on market indicators and trends.

In the volatile world of cryptocurrency, risk management is paramount. We diligently analyze market patterns, historical data, and indicators to identify high-probability trades. Recent research on Bitcoin's price behavior has informed our trading decisions, guiding us in constructing one-day-to-expire put options with precision.

Each week, we set ambitious yet achievable goals for our portfolio growth. This week, our target was to achieve a minimum daily premium of $11, reinvesting these earnings back into stable assets like USDC and selectively purchasing long-term put options for added protection.

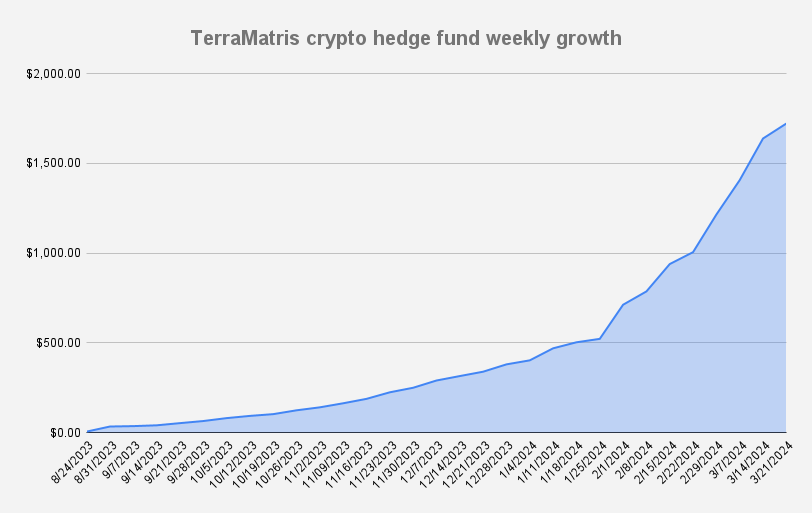

Despite market turbulence and looming corrections, TerraMatris has reached another all-time high this week, with our portfolio soaring to $1722.54. This remarkable achievement underscores our ability to navigate market fluctuations effectively. While volatility remains a constant challenge, our disciplined approach has enabled us to capitalize on opportunities and mitigate risks.

Looking ahead, we maintain a bullish outlook on Bitcoin, albeit with caution amidst potential corrections. Our analysis suggests the possibility of pullbacks to key support levels, including $60,000 and $56,000. As put sellers, our priority is to safeguard capital while remaining vigilant to emerging trends and developments.

TerraMatris Token (TERRAM) Update:

Exciting developments are underway with our native TerraMatris token (TERRAM) on the Solana blockchain. With 10,000 tokens in circulation and a starting price of $1.08, our token offers investors a unique opportunity to participate in our ecosystem. Additionally, we anticipate a 10% airdrop once our TVL reaches $2,000, promising further rewards for our loyal supporters.

Terram Token Airdrop: A 10% Reward for Every Holder as Fund Targets $2,000 Milestone by Mid-2024

Conclusion: In conclusion, this week has been one of resilience and growth for TerraMatris. As we continue to navigate the dynamic crypto landscape, our commitment to sound investment principles and risk management remains unwavering. We invite you to join us on this exciting journey, explore the possibilities of TERM tokens, and stay tuned for further updates and developments.

Thank you for your continued support, and until next time, happy investing!