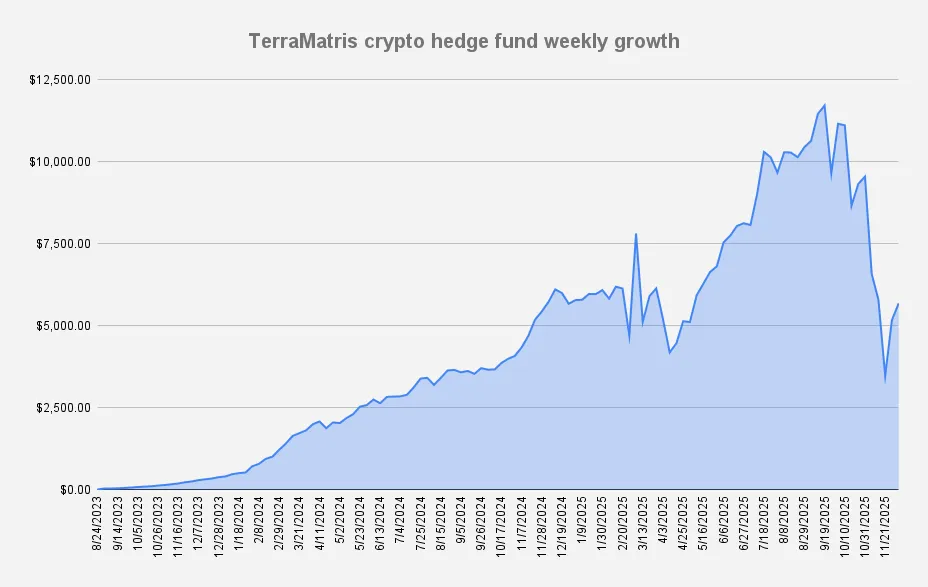

As of December 5, 2025, the TerraM Multi-Asset Crypto Options Fund is up +9.87% week-over-week, giving as a hope that the worst is behind us, and we should focus on growth.

Our overall drawdown has now improved to –51%, a meaningful recovery, though still well below the fund’s mid-September all-time high. Year-to-date, we are up +0.04%, slightly outperforming Bitcoin (–1.63%) and modestly outperforming ETH (–5.32%). This highlights that our returns remain highly directional and strongly correlated with the broader market—largely “riding the wave” while seeking to extract incremental income through our yield/option overlays.

Options Income

This week, the TerraM Multi-Asset Fund generated $231 in options premiums, what is impressive 4% weekly return on capital.

Over recent weeks we sold ATM covered calls below our break-even. This week we were challenged and had to roll up and out; we still collected net credit, but it highlighted the classic trade-off—premium income vs capped upside, with the other risk being turning into a bagholder in a drawdown.

The good thing is we rolled 2.2 ETH of calls up from 3,100 to 3,150 while still collecting premium—so we’ve effectively added about $180 of potential value for next week (~$110 from the higher strike if called away + ~$70 premium), and in case if ETH doesn’t hold above 3,150, we still got paid.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Long Calls | Short Puts |

|---|---|---|---|---|

| ETH | 2.2 ETH | $3,615 | $3,100 (1.5) $3,800 (0.2) $4,200 (0.4) | $3,800 (0.1) |

| SOL | 19 SOL | $172.55 | $150 | — |

| BTC | 0.02 BTC | $110,025 | $95,000 | — |

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

While we’re in adjustment mode, we are not opening or increasing new positions—we’re working strictly with existing spot and perpetual holdings. This week, we converted 0.1 ETH back into spot, reducing the number of active adjustment trades while increasing margin debt tied to our remaining long perpetual exposure.

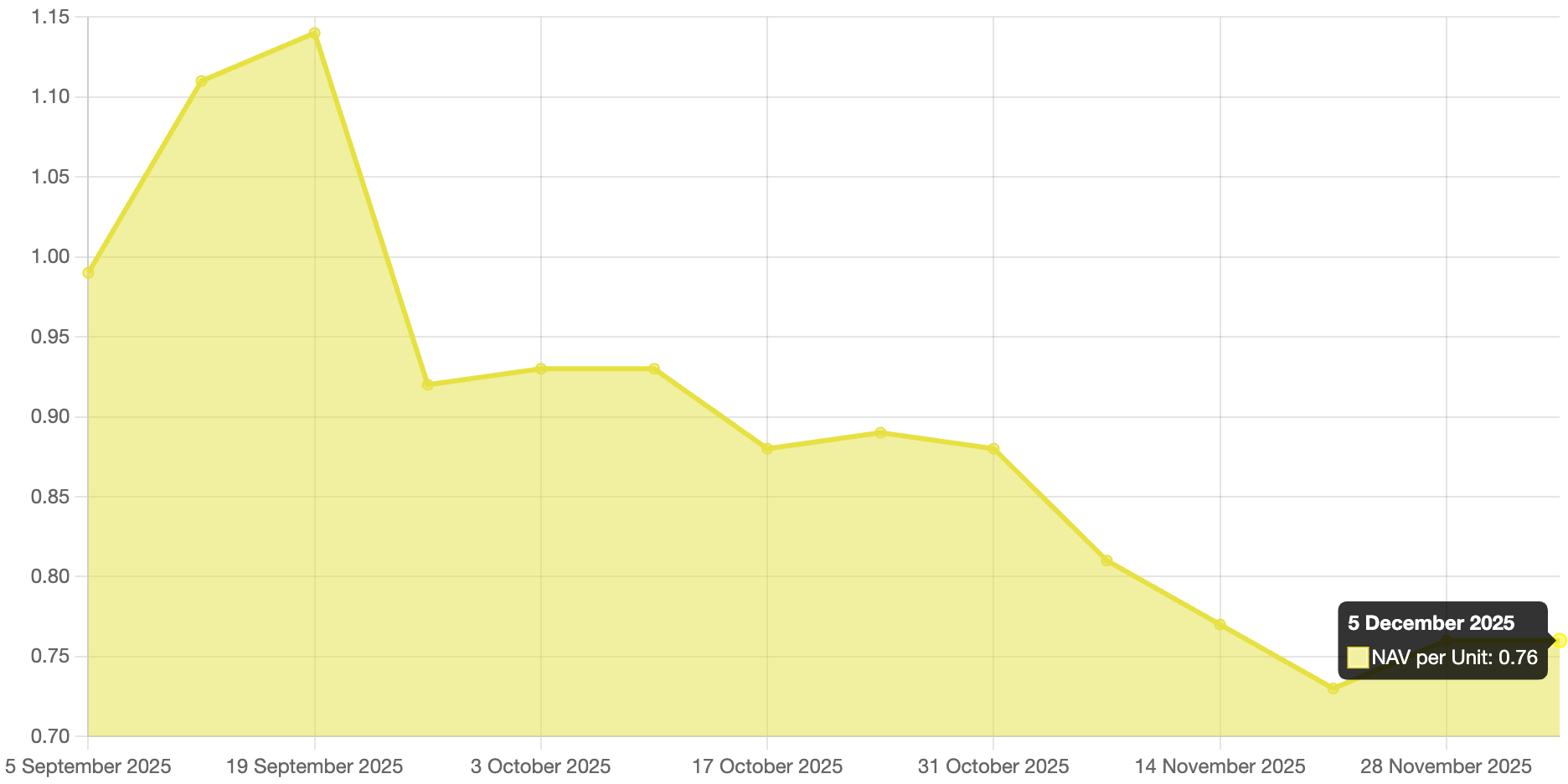

Solana Covered Call Growth Fund

Our open-ended Solana Covered Call Growth Fund grow by a mere +0.13%, keeping the NAV per unit now at $0.76. We were able to increase our long spot holdings to 35.57 SOL with break even price $175.35

Options selling generated $46 this week all reinvested into spot SOL.

Our goal is to gradually grow the fund to 100 SOL. Although we have liquid cash available, we remain cautious about unexpected market moves. The main challenge with SOL options is limited liquidity and a lack of suitable roll dates when positions come under pressure. The all options premium made this week comes from Seling Janury 30, 2026 covered calls. As an alternative, we’re also considering allocating part of the portfolio to DeFi for staking rewards. In the meantime, we continue to accumulate SOL slowly and methodically.

TerraM token

Our native TerraM token held steady at $3.27. That’s encouraging—especially given the currently thin liquidity, which is something we’re actively addressing. This week, we added liquidity back to the pool, allocating 20% of the TerraM Multi-Asset Fund’s options income to support it.

What else happened this week?

- With the Terramatris crypto hedge fund management team heading to India for the holiday season, we’re launching a simple beer-sharing crypto meetup at Palolem Beach, Goa on December 25.

- We also prepared and published the Solana Covered Call Growth fund performance report for November

- Additionally, we published a longer article on the biggest challenges we’re facing while running the Solana Covered Call Growth Fund.

The Bottom Line

This week’s rebound and improved drawdown indicate recovery is underway, but correlation remains high our edge continues to come from disciplined overlays and risk-managed positioning.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.