Solana covered calls sound straightforward: hold SOL, sell calls, collect premium, compound.

And yes—most of the usual “covered call problems” are real: you cap upside in rips, you can get dragged into rolling, and in a drawdown you risk becoming a paid bagholder. But with proper risk management and discipline, those aren’t the problems that keep us up at night. They’re part of the deal, and we price them in.

The real challenge we face running the Terramatris Solana Covered Call Growth fund is simpler and more annoying: the market structure on SOL options just isn’t mature enough yet. It’s not about making the perfect strike/expiry choice. It’s about the fact that, many weeks, you don’t really have a choice at all.

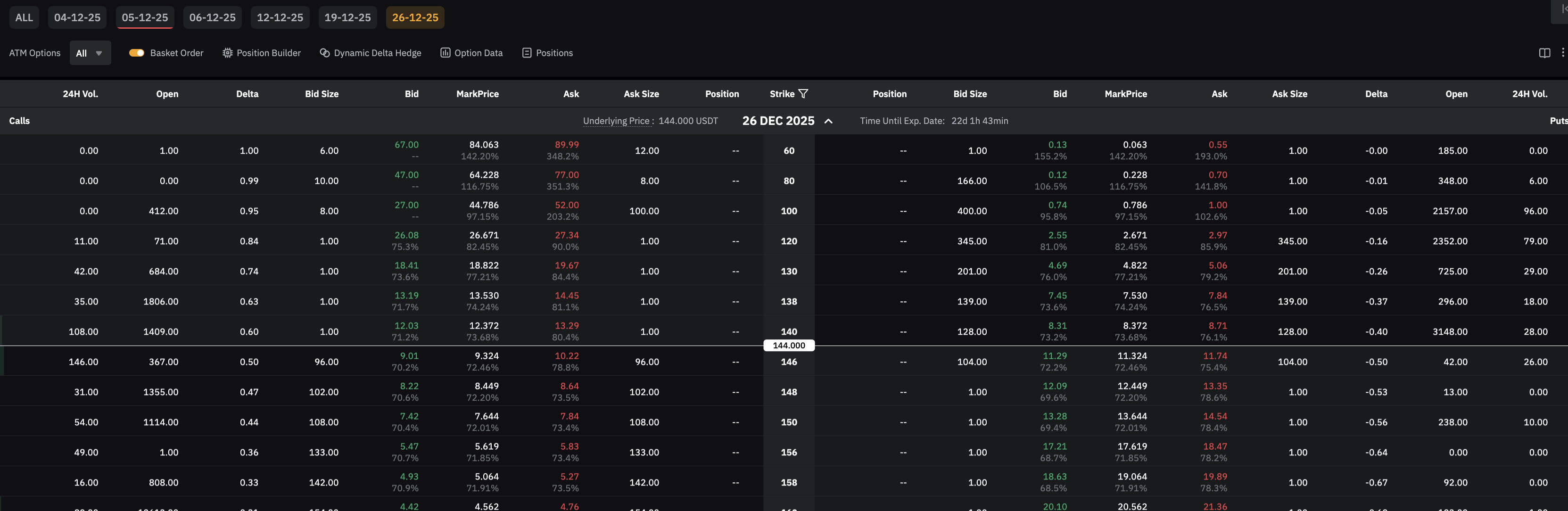

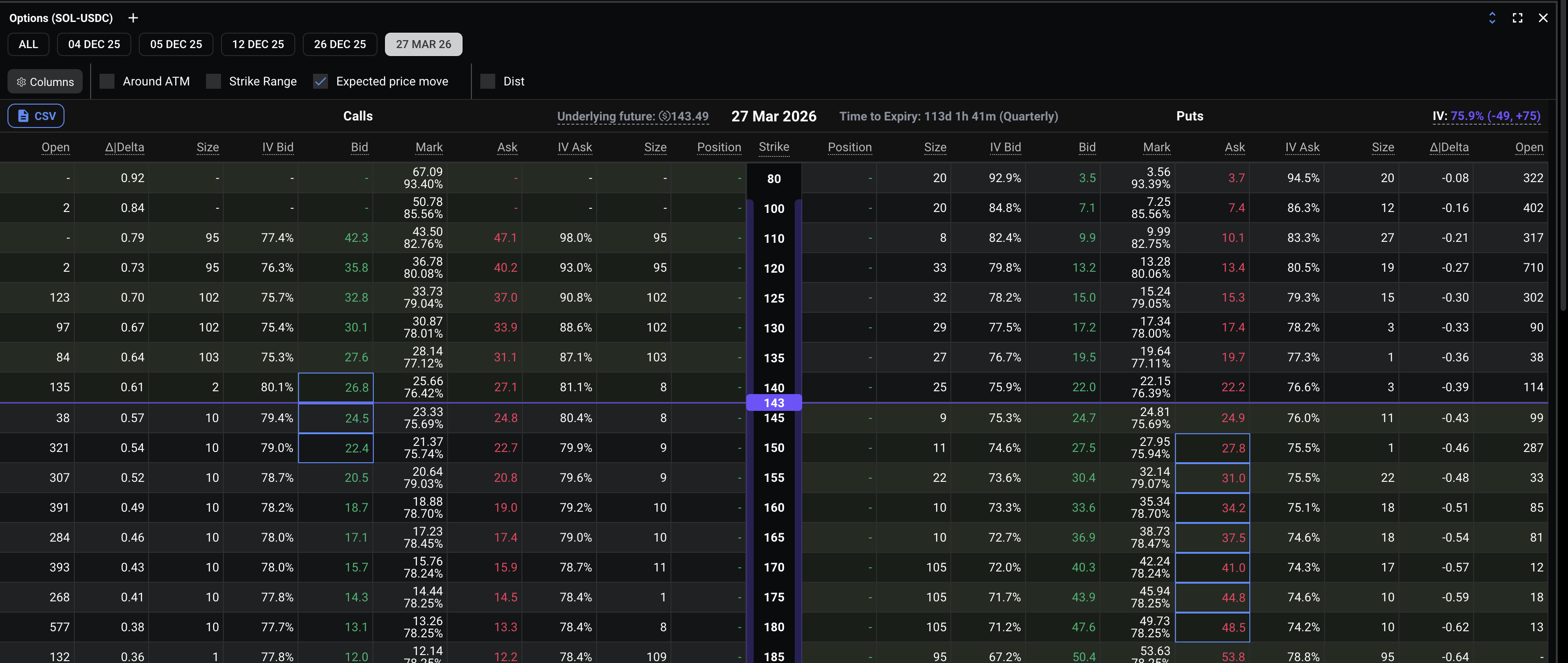

On Solana, there are not enough strikes and not enough dates to select from. That one constraint winds up influencing everything: how we roll, how we size, how we manage assignment risk, and even how we think about performance. If you’ve traded BTC and ETH options for a while, you get spoiled. You’re used to a deep chain, many expiries, lots of strikes, decent liquidity, and the ability to express a view precisely. On SOL, you often have to work with what’s listed—and what’s listed can be limiting.

A concrete example: on Bybit the furthest listed expiry we can reliably work with is about one month out (as of 2025). That puts a ceiling on the strategy.

If price challenges your calls and you want to “roll out,” there’s only so far you can go before you hit the end of the road. That means you’re managing a covered-call process inside a tighter box: you have more frequent decision points, less flexibility to smooth out outcomes over time, and fewer clean ways to shift risk from this week to a later month when the tape turns weird.

Deribit is better, mostly because you can see a bit further with quarterly options. That helps. You have more room to manage time and roll scheduling, and you’re not forced into a purely short-dated rhythm. But even there, Solana’s options market doesn’t feel like BTC/ETH. The chain is still thinner, and the experience is different in a way that matters: liquidity and depth are shallower.

This is the second major constraint. On SOL options, execution is not an afterthought. Spreads are often wider, depth is lighter, and in fast markets you can feel it immediately. When you’re rolling or adjusting, you’re not just deciding “what’s the best strike.” You’re deciding “what’s the best strike that actually trades well enough for our size without donating P&L to slippage.” In BTC and ETH, you can often scale and move positions with minimal friction. In SOL, the microstructure itself can become a performance driver—especially once you start trying to grow the portfolio beyond hobby size.

And that’s where the real tension shows up. Covered calls can be a clean, systematic strategy when the options surface is rich. When the surface is thin, it becomes more path-dependent. One choice today can corner your choices next week because the chain simply doesn’t give you elegant alternatives.

So what do we do about it? First, we don’t pretend it’s not there. We accept that Solana options are still developing and we run a process that respects that reality. That means being conservative on size relative to liquidity, being picky about when we roll and how, and not forcing trades just because it’s “the weekly routine.” Some weeks the best risk management decision is doing less, not more.

Second, we keep the portfolio open anyway, because there’s still a real opportunity here. Solana has volatility, it has narrative-driven moves, and it has enough option premium at times to make the strategy worthwhile—as long as we keep our discipline and don’t overtrade thin markets. Our intent is to continue growing the Solana Covered Call Growth portfolio and push it to 100 SOL in the foreseeable future. That’s a clear milestone for us: good size, meaningful portfolio impact, but still manageable within the realities of current liquidity.

Once we reach that 100 SOL level, we want to add a second engine—not to replace covered calls, but to complement them and reduce dependence on a thin options chain. The plan is simple: allocate a portion of our SOL into basic DeFi yield activities such as staking, lending, and other conservative yield routes that make sense at the time.

The point isn’t to chase the highest APY on the internet. The point is to diversify the portfolio’s sources of yield so we’re not forced to squeeze every last basis point out of the options market when the chain and liquidity aren’t offering good risk/reward that week.

To be clear, this is a “Phase 2” step. We’re not mixing too many moving parts while the portfolio is still scaling. The priority right now is to run the covered-call program cleanly, keep it understandable, keep it disciplined, and grow the base position. After 100 SOL, adding staking/lending on a portion becomes a practical way to stabilize returns and make the whole system less sensitive to the limitations of listed expiries and shallow depth.

The bottom line is this: the textbook risks of covered calls are real, but they’re not the headline issue for us. The headline issue is selection and market depth. Solana options are improving, but for now they’re still a smaller, less liquid ecosystem compared to BTC and ETH. We’re building around that constraint, not fighting it. And as the market matures, the strategy gets easier—not because we’ll suddenly become smarter traders, but because the market will finally give us the tools BTC and ETH traders take for granted.

We’ll keep documenting what we do, why we do it, and what the market allows (or doesn’t allow) each week. That’s part of the edge too: not just “selling calls,” but running a process you can explain, measure, and stick to—especially when the chain is thin and the easy choices don’t exist.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.