On January 23, 2026, the TerraM token traded at $2.75 (+2.23%). Trading activity remained modest, with transactions skewed mostly toward buys. During the week, we increased liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 1.48% of total supply bringing our total market cap to $27,500 (+$600).

Our larger objective is to expand the liquidity pool to 10%, but the next key milestone is getting past 2%. We anticipate achieving this within 4–5 weeks. Until liquidity improves, slippage will continue to be significant.

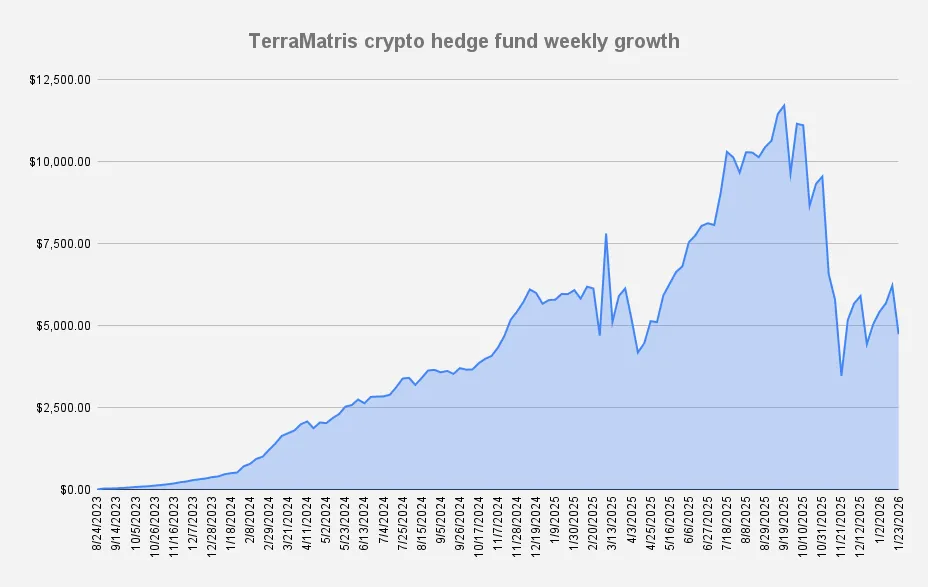

TerraM Multi Asset Fund

Meantime TerraM Multi-Asset Crypto Options Fund experienced another massive -23.86% week-over-week drop, marking first negative week in 2026. The past few months have felt like one step forward, two steps back.

The drop can be linked to renewed trade-war rhetoric and the Greenland issue, which together increased macro uncertainty and pulled overall asset prices down. Been there, seen that. With three more years of President Donald Trump, we can reasonably expect elevated market volatility.

See: How Crypto Reacts to U.S. Tariff Announcements — and Why It Hurts More Than Stocks

From a personal note, I followed President Trump’s live coverage on CNBC from Davos with great interest. While the rhetoric may sound harsh, the points themselves appear largely valid. What is surprising is that mainstream media later focused almost exclusively on Greenland.

That said - TerraM Multi-Assets Fund drawdown from all time high back in September 2025 is –59.56%. While YTD fund is down -11.99%, underperforming Bitcoin (+2.45%) and ETH (-0.8%).

Nevertheless, the fund generated $175 in options premiums, representing an impressive 3.69% weekly return on capital. This return, however, comes with a trade-off: we are selling in-the-money (ITM) covered calls. As a result, the strategy may underperform in the event of a strong market recovery—a classic limitation of covered call strategies.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Strike |

|---|---|---|---|

| ETH | 2.8 ETH | $3,408 | $3,000 |

| SOL | 13 SOL | $182.07 | $138 |

| BTC | 0.02 BTC | $105,438 | $93,000 |

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

This week, we converted 0.1 ETH to spot, increasing our long spot position to 1.3 ETH. Unfortunately, this adjustment came at a cost, increasing our margin debt to approximately –2,739 USDT. With weekly premium of $175 per week, we expect to fully eliminate the margin debt within the next 15-16 weeks.

Additionally this week, we decided to unwind part of the SOL exposure by rotating it into ETH. We closed 3 SOL positions and opened an additional 0.1 ETH, keeping the same break-even models. The plan is to gradually exit SOL entirely from adjustment trades, as SOL exposure is already handled separately in the dedicated Solana covered call fund (more on that below).

Solana Covered Call Growth Fund

Solana Covered Call Growth Fund was no exception for the downside dropping its NAV per unit to $0.74. While at the end of week we were able to increase our long spot holdings to 44.42 SOL with break even price $167.06

Options selling generated $21.6 this week all reinvested back into spot SOL.

For now on, we have decided to switch to monthly options trading on Solana. The rationale is straightforward: compared to ETH and BTC, Solana has significantly less liquidity and fewer available expiry dates, which makes weekly trade adjustments relatively ineffective.

All option premium earned this week came from selling cash secured put options, expiring February 27, 2026.

The bottom line

As structurally bullish but risk-aware option sellers, we remain exposed to further downside in the short term. However, disciplined premium generation, gradual deleveraging, and a long-term conviction in crypto fundamentals keep us cautiously optimistic despite elevated volatility and recent drawdowns.