At Terramatris we are always exploring new ways to structure option strategies around crypto assets. One of the more interesting challenges we’ve faced recently is figuring out how to trade covered calls on XRP.

Our favorite trading platform, Bybit, unfortunately does not yet offer XRP options. That left us looking for alternatives, and naturally, Deribit became our next candidate. Deribit does offer XRP options, but as always, the devil is in the details.

The Challenge: Collateral Rules on Deribit

Deribit lists XRP options, but they are settled in USDC. At the time of writing, there is no way to post XRP directly as collateral for call selling. This complicates things because in a “classic” covered call setup, you’d hold the underlying asset (XRP in this case) and sell calls against it.

Instead, Deribit requires USDC margin. That forced us to think a bit more creatively.

Our Solution: Bridging Bybit and Deribit

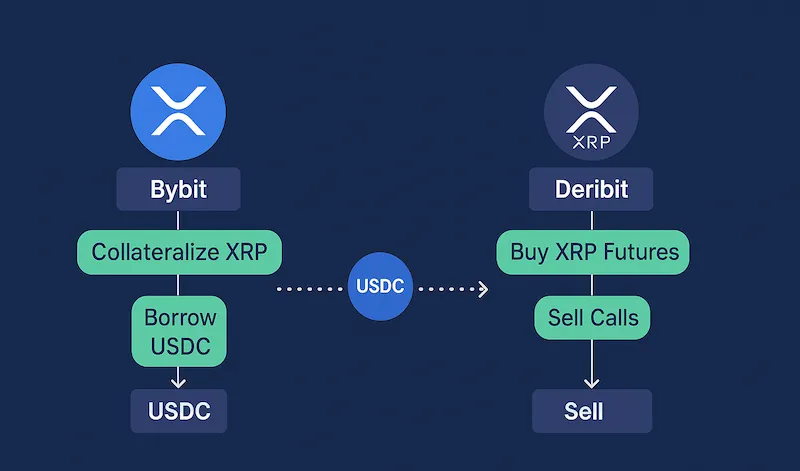

We came up with what we believe is a smart workaround:

- Collateralize XRP on Bybit – We locked up some of our XRP holdings on Bybit as collateral.

- Borrow USDC – Against that XRP, we borrowed USDC, paying about 11% annual interest.

- Transfer USDC to Deribit – The borrowed USDC was moved to Deribit to serve as option margin.

- Replicate XRP exposure – Since we wanted the trade to mimic a traditional covered call, we bought long XRP perpetual futures on Deribit with 25x leverage.

Effectively, this setup allowed us to hold XRP exposure (via leveraged futures) while still being able to sell call options on Deribit.

Why This Works (and Why It’s Imperfect)

This approach isn’t a perfect covered call structure, but it comes surprisingly close:

- The borrowed USDC plays the role of collateral for selling calls.

- The long XRP futures replicate holding spot XRP, giving us the underlying exposure.

- The sold calls then generate premium just like in a standard covered call strategy.

Of course, there are trade-offs:

- Borrowing USDC at 11% creates a financing cost that eats into returns.

- Using 25x leverage on the long futures introduces liquidation risk if not managed carefully.

- There is ever changing funding fee for holding perpetual futures

- It’s more complex than simply selling calls against spot XRP.

Still, as an experimental structure, it’s a viable workaround until platforms like Bybit start offering XRP options with XRP collateral support.

Looking Ahead

For us, this was a valuable exercise in thinking creatively about option structures in crypto. It’s an experiment we’ll continue to fine-tune, exploring different leverage levels, roll strategies, and ways to minimize financing costs.

The crypto options landscape is evolving quickly. For now, this setup gives us a way to monetize our XRP exposure through covered calls, even if it requires some creative bridging between platforms.