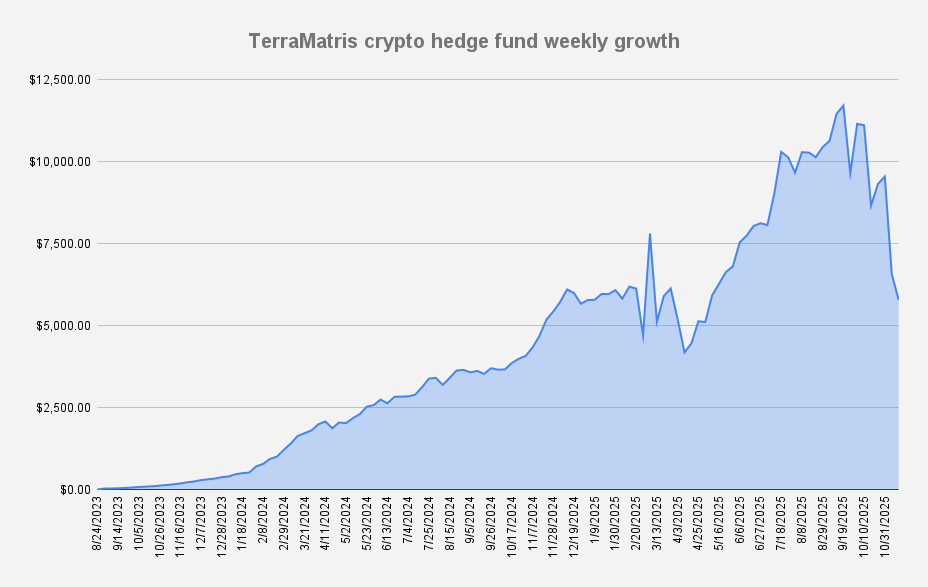

As of November 14, 2025, the value of the TerraM Multi-Asset Crypto Options Fund has declined by another -11.97%. Our drawdown has reached a new low of –50.58% in just a few weeks — a striking reminder of how quickly conditions can deteriorate. Even though most indicators are washed out and a recovery could be near, we remain cautious and do not rule out further downside. We still hope to be wrong.

There is one major event worrying us: a death cross on the Bitcoin chart. In fact, it’s not just potential it’s looking increasingly inevitable.

A death cross occurs when the 50-day moving average falls below the 200-day moving average. This signal typically reflects a long-term shift from bullish to bearish momentum. Historically, it doesn’t always trigger an immediate selloff, but it often marks periods of extended weakness, slow recoveries, or deeper downside. The mechanics are simple: the faster-moving average (50-day) reacts quickly to recent price declines, while the slower one (200-day) represents the broader trend. When the short-term line crosses below the long-term line, it signals that recent price action has deteriorated enough to drag the overall trend down with it.

While markets can sometimes bottom shortly before or after a death cross, the pattern itself highlights deteriorating momentum and the risk of further drawdowns — exactly why it remains a key concern for us right now.

We’re not making price predictions, but a move toward 84,000 for Bitcoin seems increasingly plausible. Again, we hope we’re wrong.

Our open-ended Solana Covered Call Growth Fund also followed downtren, declining by another -5.04%, with the NAV per unit now at $0.77. Although Solana retraced more than 15%, the fund operates without leverage, so the drawdown poses no structural risk — we simply ride out the market move.

Our native TerraM token was without changes, thats encouraging, few bot traders and long term holders there.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, the TerraM Multi-Asset Fund generated $188 in options premiums, what is impressive 3.24% weekly return on capital.

For the sake of transparency, the higher options income comes with certain trade-offs. We sold covered calls below our break-even levels. This means that if the market experiences a strong rally, we may forgo part of the upside potential.

Trades and Adjustments (USDT Settled / Weekly)

- 1.29 ETH – Break-even: $4,113 | Long calls: $3,200 (0.69), $3,800 (0.2) $4,200 (0.4) | Short put: $3,800 (0.1)

- 13 SOL – Break-even: $203.93 | Long calls: $150

- 0.02 BTC – Break-even: $112,995 | Long calls: $101,500

Crypto Algo Trading and Machine Learning: Options Probability Bot

Last week we spent time writing Python code and building machine-learning–driven algo trading bots. It’s both fun and useful — it keeps us sharp while giving us an edge in understanding market behavior. We also launched our first fully functional 1DTE SOL trading bot. Functional doesn’t mean profitable, and that’s the part we’re working on now: extending the system with machine-learning models to identify higher-probability setups.

In parallel, we continued developing our options-trading signal engine, which we distribute through a separate newsletter.

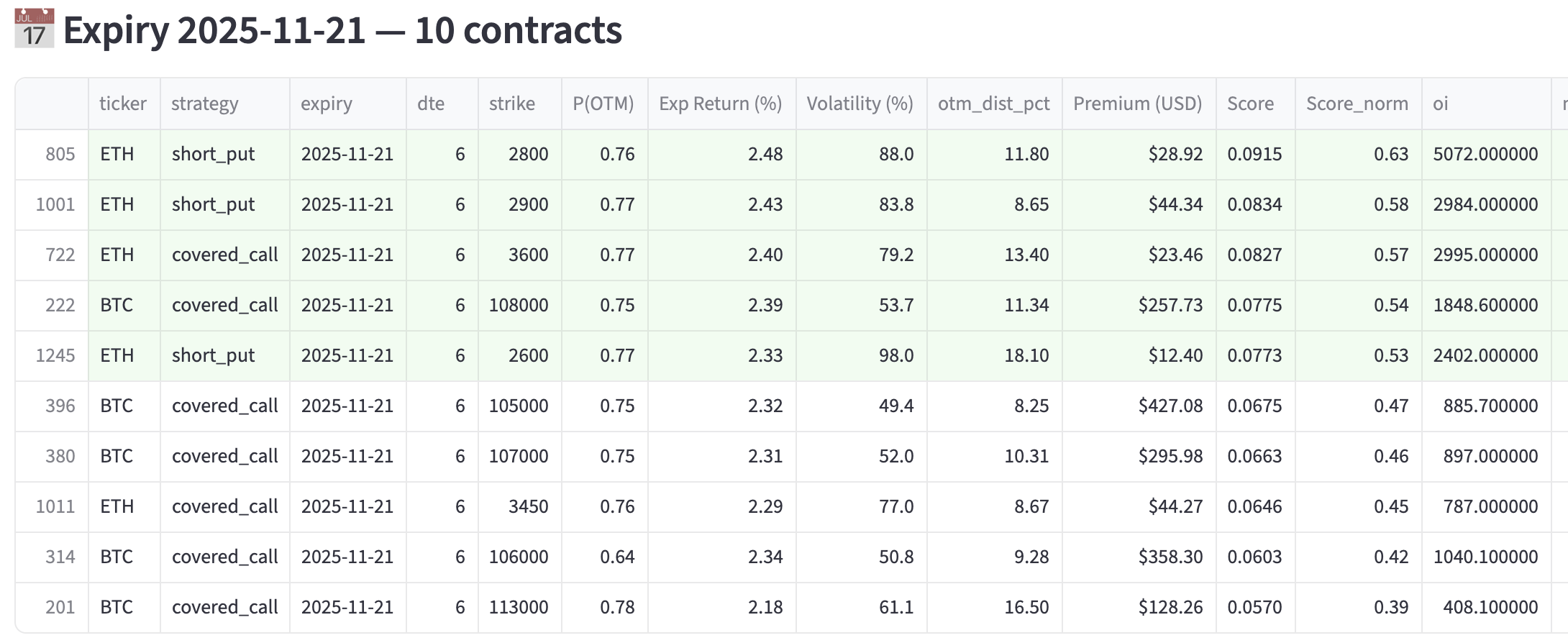

Most importantly, we made solid progress fine-tuning our Options Probability AI Bot. It’s proving especially helpful for novice traders who are still learning how to assess risk and probability. Without further preamble, here are a few signals the bot picked up for last week’s expiry:

The options market remains unusually skewed toward elevated out-of-the-money premiums, especially on BTC covered calls and short ETH puts with just six days to expiry. This kind of pricing typically reflects a mix of high implied volatility and cautious positioning ahead of near-term catalysts. The distribution of strikes suggests traders are willing to sell upside risk while collecting modest returns on deeply OTM downside exposure.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.