The Terramatris Solana Covered Calls Growth Fund (SOLCGG) continued its systematic income strategy through covered call writing on Solana (SOL).

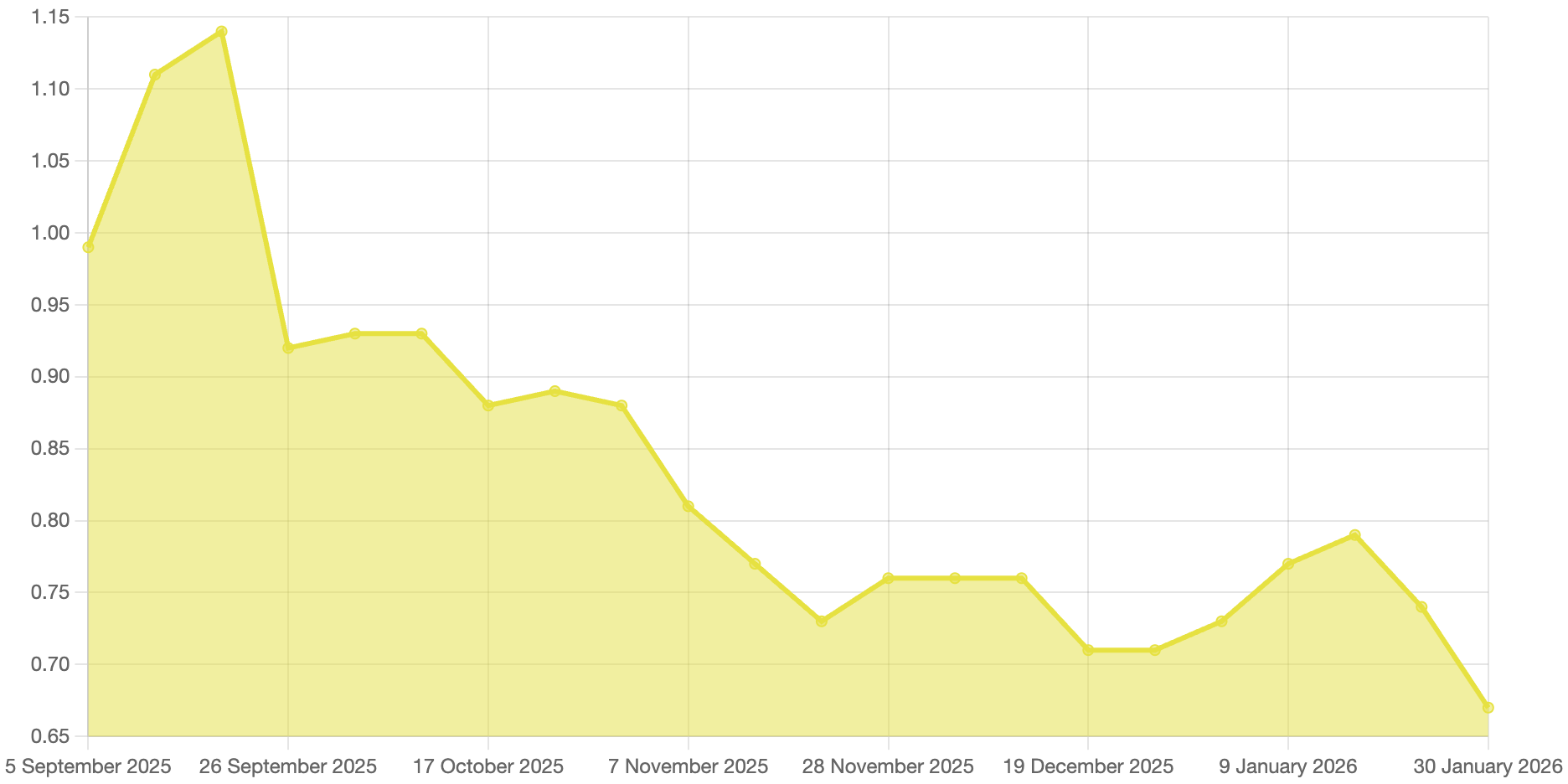

The Fund’s NAV per unit declined from 0.71 to 0.62 over the month. While this represents a noticeable decrease, the percentage decline remained more moderate than the underlying late-month spot move, supported by continued premium capture from covered call writing.

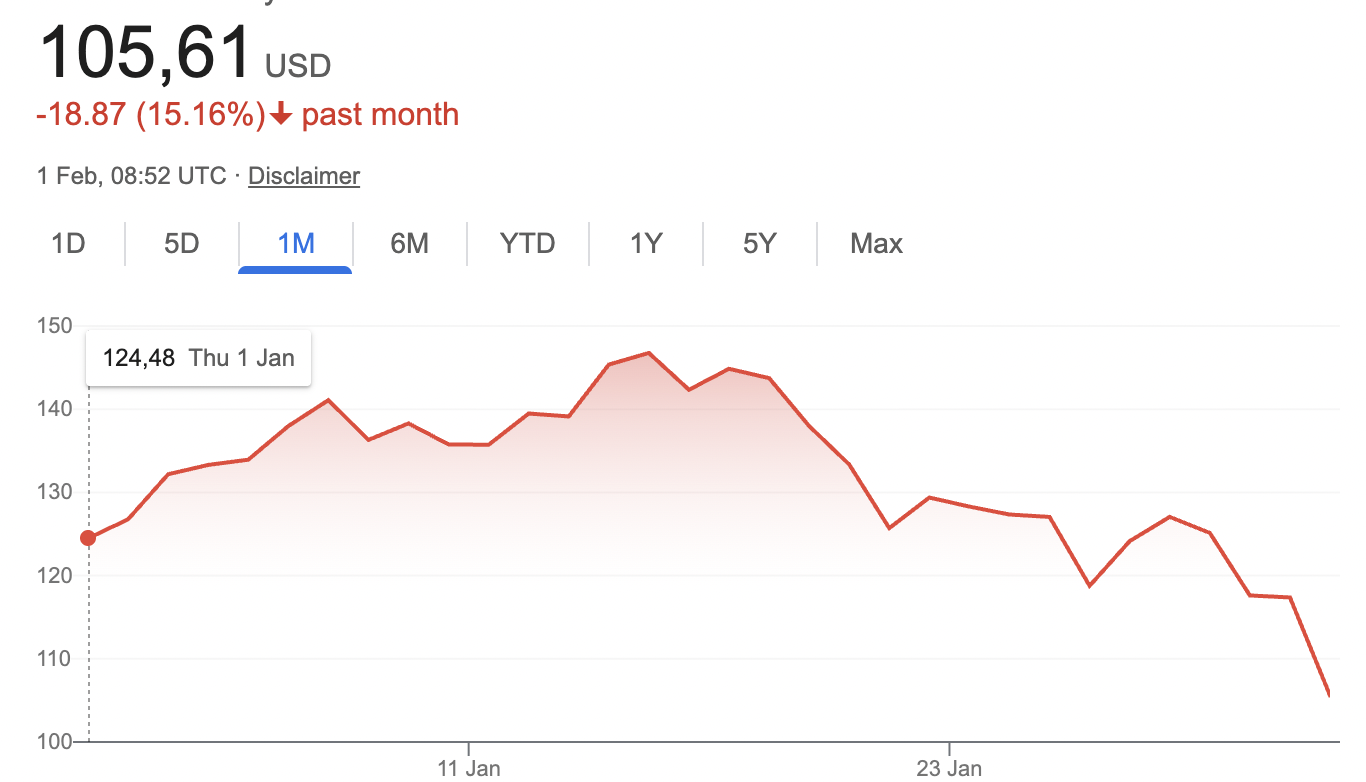

January 2026 was largely range-bound for SOL, with the price trading for most of the month in the $120–$145 range. However, in the final days of January, SOL sold off sharply, dropping to approximately $105.

On a month-over-month basis, SOL declined from roughly $125 to $105, reflecting a meaningful late-month drawdown after several weeks of relative stability.

Fund Development

As of January 31, 2026, the Fund had 13,272 shares issued, compared to 12,839 in December 2025.. This reflects a month-over-month increase of 3.35% in total AUM, driven by new subscriber inflows and continued GP contributions.

Trading Activity

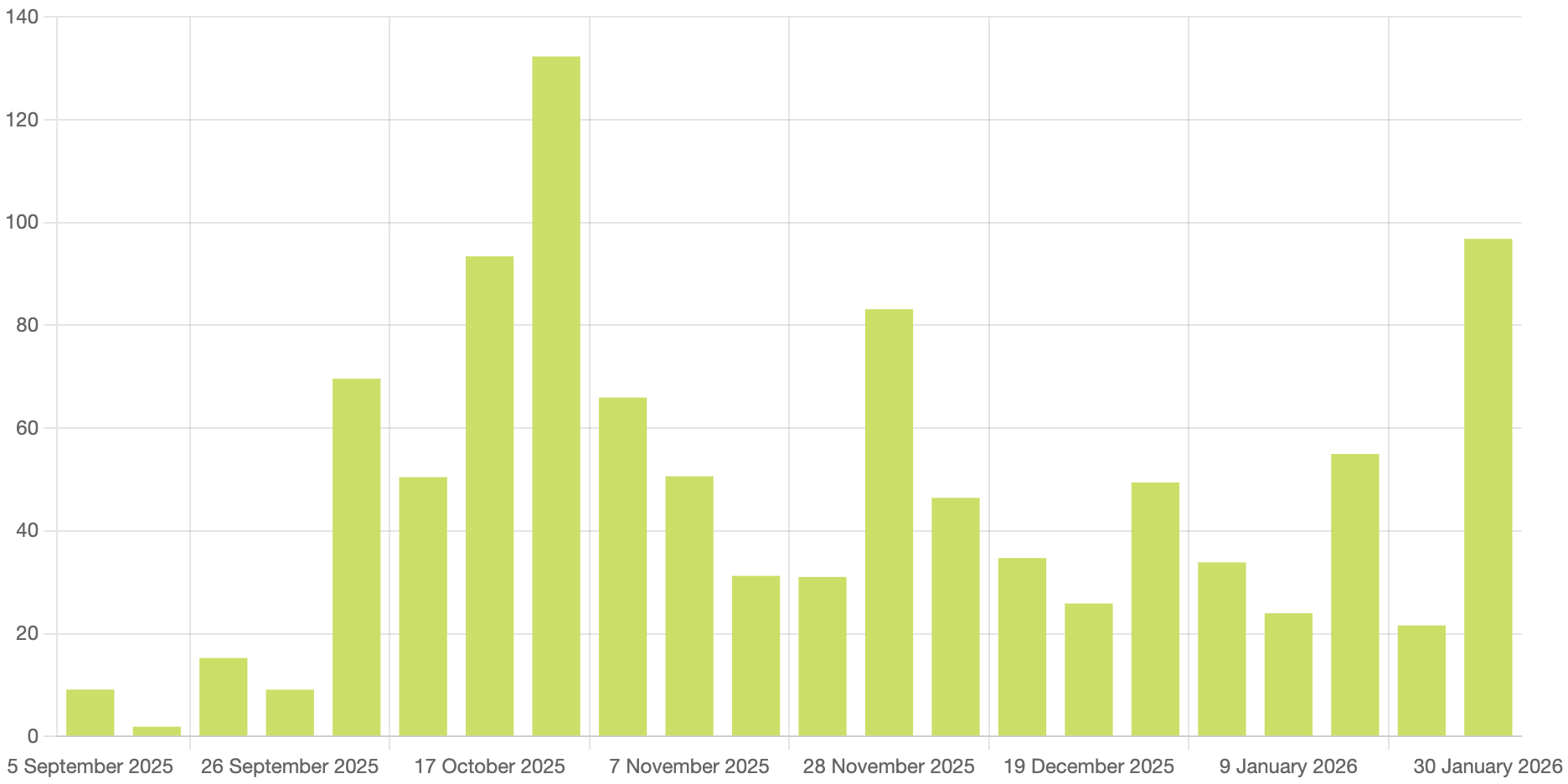

Covered call writing remained the Fund’s principal income stream. January featured multiple short-dated Solana call cycles with active rolling and strike adjustments to balance premium income and assignment risk.

Market volatility provided favorable conditions for premium capture, though declining SOL prices compressed total NAV by month-end. In total, $231.27 was earned from options trading in January, representing approximately a 2.81% return on capital.

No margin calls or operational issues were recorded. Liquidity and position sizing adhered to internal risk controls.

SOL Holdings

By the end of the month, the fund held 48.29 SOL with an average purchase price of $172.24 and a break-even price of $156.97

The fund's total SOL holdings increased by 8.86 SOL, while the average buy price decreased by $17.23, improving the break-even level by $14.33.

Fees & GP Alignment

- Management Fee: 0.1667% monthly (converted into GP shares).

- GP Commitment: All fees reinvested into Fund units, maintaining full capital alignment.

Outlook for February 2026

Following the sharp late-month drawdown in January, the Fund expects a potential rebound in SOL toward the $120 level during February. At the same time, the strategy remains cautious and does not exclude the possibility of further downside, particularly if broader crypto sentiment weakens.

Given current market conditions, the Fund is not planning to sell additional weekly options during February, prioritizing capital preservation and flexibility.

Disclaimer

This report is intended solely for existing stakeholders and internal review. It does not constitute an offer, solicitation, or recommendation to buy or sell any financial instrument.