bybit

Trading Covered Calls on XRP with Deribit

| 150 seen

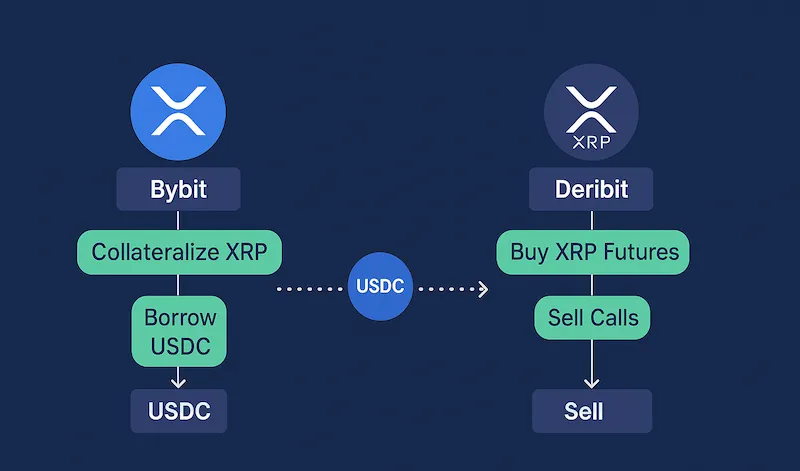

At Terramatris we are always exploring new ways to structure option strategies around crypto assets. One of the more interesting challenges we’ve faced recently is figuring out how to trade covered calls on XRP.

Our favorite trading platform, Bybit, unfortunately does not yet offer XRP options. That left us looking for alternatives, and naturally, Deribit became our next candidate. Deribit does offer XRP options, but as always, the devil is in the details.

The Challenge: Collateral Rules on DeribitDeribit lists XRP options, but they are settled in USDC. At the time of writing,…