Weekly updates

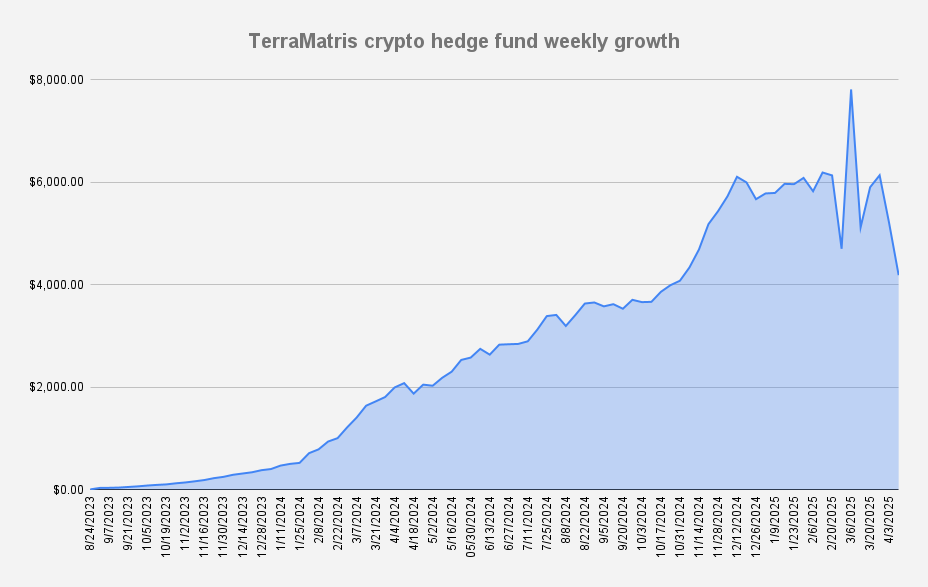

Episode 86 / Crypto Hedge Fund Falls to $4,187.39 After another - 19.52% Weekly Drop

| 104 seen

As of April 11, 2025, the fund’s value has declined to $4,187.39, marking a -19.52% drop week-over-week, equivalent to a -$1,015 decrease in dollar terms. This marks the second consecutive week of losses, further highlighting the ongoing instability in the broader market.

We now stand -44.03% below our all-time high of $7,811, recorded on March 6, 2025, a sobering reminder of the persistent volatility that continues to shape the current macroeconomic landscape. YTD crypto hedge fund has dropped to -26.28%

This week’s downturn was largely driven by escalating geopolitical tensions, most notably the newly imposed tariff wars announced by President Trump. The market reacted sharply, with Ethereum—our most heavily impacted position - falling below the critical $1,500 mark, sparking a wave of forced liquidations and panic-driven selling.

While ETH has since recovered slightly above this threshold, the turbulence left a visible mark on our portfolio’s performance.

Ethereum has been bleeding heavily, and a retest of the $1,000 level is not off the table.

Whether we get there largely depends on Bitcoin's next moves. If Bitcoin fails to hold support at $75,000, there’s a high probability it will continue to slide toward $68,000. Adding to the bearish sentiment, Bitcoin has formed a death cross on its 50/200-day moving averages — a classic indicator of potential downward momentum.

Despite viewing this as a healthy market correction, the reality is tough: we’re holding Bitcoin purchased at levels above $108,000. At this stage, there’s little we can do besides holding our bags, selling covered calls against our positions, and waiting for a recovery.

Trade Adjustments

A few weeks ago, we restructured our deep in-the-money ETH put options into covered calls on long perpetual futures to optimize risk, enhance capital efficiency, and reduce downside exposure. This adjustment has proven effective as the market begins to stabilize.

Current positions in long perpetual futures (settled in USDC):

- 0.02 BTC (break-even: $106,577) lowered by -$2,153 | strike $84,000 / $78,000 (short)

- 2.1 ETH (break-even: $2,589) lowered by -$111 | strike $1,450 (short)

- 5 SOL (break-even: $159.06) lowered by -$2.97 | strike $124

Over the past several weeks (and even months), we've been generating options premium primarily through trade adjustments rather than initiating new positions. Despite the challenging circumstances and the underperformance of our existing holdings, we still managed to collect $183.4 in premium this week from these ongoing adjustments—a modest but meaningful contribution under the circumstances.

Converting these positions to spot crypto would require $8,363.74 in cash—an impractical sum given our constraints. By using long perpetual futures, we need only a fraction of that, though funding fees remain a burden.

With current strike prices and options premiums there is still about $2,929 funds to be recovered to break even our suffered positions. One of the short term goals is to sell weekly call options to offset the loses and generate cash, which later can be used to purchase actual spot crypto. As while in the recovery mode we are not buying any additional spot crypto as we don't have enough cash / and we don't want to use margin. Cash is KING!

No new capital has been injected into the fund, and liquidity remains a top priority.

TerraM Token Update

The TerraM token continues to demonstrate resilience, outperforming much of the broader crypto market, but thats mostly attributed that there are just a few TerraM token holders and seems most are interested in long term growth, which is great!

- Current TerraM Price: $2.60 (unchanged week-over-week)

We are committed to improving liquidity for TerraM, but given current market conditions, we do not anticipate a significant liquidity increase or another buyback until the total fund value reaches $8,000.

The crypto fund endured another difficult week, shedding 19.5% and deepening YTD losses to over 26%. Ethereum's sharp drop and Bitcoin’s looming technical breakdown are keeping markets unstable. Strategic options restructuring has helped marginally lower break-evens and generate small cash inflows. TerraM remains stable, but all eyes are now on liquidity, premium collection via weekly calls, and careful portfolio management until recovery conditions improve.

This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.

Episode 85 / Crypto Hedge Fund Plummets 34.18% in March 2025

| 200 seen

The Terramatris crypto hedge fund endured a punishing March, with brief recoveries eclipsed by a dramatic late-month collapse. As of March 31, 2025, the fund’s value stood at $5,142, reflecting a steep -34.18% drop month-over-month. Year-to-date, our fund is down -9.45%, underscoring the relentless challenges we’ve faced.

March 2025 has been a grueling period for Terramatris, with our performance trailing major cryptocurrencies.

- Bitcoin (BTC) ended the month down -2.98%, a modest decline compared to our -34.18% plunge.

- Ethereum (ETH), a core holding, fell -17.39%, magnifying our losses due to our heavy reliance on ETH put options that unraveled as the asset staged a late recovery.

- Solana (SOL) dropped -8.33%, outperforming both us and ETH but still mirroring the broader market’s struggles.

Our outsized losses spotlight the crippling impact of our options strategy—particularly the ETH puts, which buckled as Ethereum clawed back from mid-month lows.

Earlier this month, we pivoted our deep in-the-money ETH put options to covered calls on long perpetual futures, aiming to mitigate risk and enhance capital efficiency. This shift cushioned some damage as ETH stabilized, but the earlier put-heavy approach left us reeling. Our current positions in long perpetual futures (settled in USDC) are:

- 0.02 BTC (break-even: $111,030)

- 2.1 ETH (break-even: $2,723)

- 5 SOL (break-even: $164.40)

Converting these positions to spot crypto would require $8,740.90 in cash—an impractical sum given our constraints. By using long perpetual futures, we need only a fraction of that, though funding fees remain a burden.

With $2,570 still to recover, we’re selling weekly calls to generate cash—crucial since we’re steering clear of spot crypto purchases or margin in this cash-strapped recovery phase. Cash is KING! We plan to begin converting long perpetuals into spot crypto by late April, allocating half our cash reserves, ideally after lowering our break-even prices. We project $300–$400 in cash from call options in April to support this effort.

No new capital has been injected, and liquidity remains our lifeline.

TerraM Token Update

The TerraM token price rose from $2.26 to $2.60, a rare bright spot amid the wreckage. This uptick stems from two buybacks executed early in March, bolstered by a small, loyal holder base focused on long-term growth. We’re dedicated to enhancing TerraM liquidity, but with the fund at $5,142, significant steps like another buyback are deferred until we reach $8,000.

Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

March’s fleeting gains were obliterated by a brutal finish, exposing our vulnerability to ETH’s volatility and the market’s unpredictability. Our priorities now are:

- Risk Mitigation & Capital Preservation – Shielding against further turbulence.

- Strategic Adjustments – Fine-tuning options strategies and hedging to recover.

For April, with no short put options open—only spot and perpetual futures—we aim to reduce our break-even prices on long futures, setting the stage for a gradual rebuild.

Institutional interest in crypto endures, but caution prevails. We believe ETH could climb to $2,500 in the long term, though near-term dips pose risks. March 2025 has been a stark lesson for Terramatris—recovery will demand precision and resilience.

This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making investment decisions.

Episode 84 / Crypto Hedge Fund Grows 3.95% to $6,138

| 61 seen

The Terramatris crypto hedge fund has continued its upward trajectory this week.

As of March 27, 2025, the fund’s value has increased to $6,138, reflecting a 3.95% week-over-week growth (or +$233 in dollar terms). This follows last week’s significant rebound, where the fund grew to $5,904—a 15.31% gain. Despite these gains, we remain -21.46% below our all-time high of $7,811, recorded on March 6, 2025, underscoring the broader market’s persistent volatility.

This week’s recovery comes amid a fragile but stabilizing crypto market. Ethereum, our most impacted position, has climbed above $2,000 following a turbulent period when it dipped below this key level, triggering forced liquidations and panic selling.

The past week has been a blend of volatility and cautious optimism. Ethereum’s rebound from its lows and Bitcoin’s uptick suggest a potential shift in sentiment, though the market remains dynamic and unpredictable. From a technical analysis perspective, we maintain a cautiously optimistic long-term outlook. We see a plausible path for Ethereum to reach $2,500 in the coming weeks or months, though near-term reversals cannot be ruled out.

Trade Adjustments

A few weeks ago, we restructured our deep in-the-money ETH put options into covered calls on long perpetual futures to optimize risk, enhance capital efficiency, and reduce downside exposure. This adjustment has proven effective as the market begins to stabilize.

Current positions in long perpetual futures (settled in USDC):

- 0.01 BTC (break-even: $108,012) lowered by -$1,067 | strike $85,000

- 1.1 ETH (break-even: $2,793) lowered by -$23 | strike $2,100

- 5 SOL (break-even: $168.58) lowered by -$3.15 | strike $134

As we have call options expiring tomorrow (March 28, 2025) - we look to generate additional options premium thus lowering our break even price for ETH to about $2,773, Bitcoin around $106,000 and SOL around $162.

It is highly likely that our Bitcoin (BTC) and Solana (SOL) options will expire in the money tomorrow. We are currently evaluating the potential strategy of converting these positions back into put options, targeting lower strike prices, while continuing to capitalize on the collection of options premiums.

With current strike prices and options premiums there is still about $1,165.32 funds to be recovered to break even our suffered positions. One of the short term goals is to sell weekly call options to offset the loses and generate cash, which later can be used to purchase actual spot crypto. As while in the recovery mode we are not buying any additional spot crypto as we don't have enough cash / and we don't want to use margin. Cash is KING!

No new capital has been injected into the fund, and liquidity remains a top priority.

TerraM Token Update

The TerraM token continues to demonstrate resilience, outperforming much of the broader crypto market, but thats mostly attributed that there are just a few TerraM token holders and seems most are interested in long term growth, which is great!

- Current TerraM Price: $2.60 (unchanged week-over-week)

We are committed to improving liquidity for TerraM, but given current market conditions, we do not anticipate a significant liquidity increase or another buyback until the total fund value reaches $8,000.

Looking Ahead

While the fund has posted two consecutive weeks of gains, the market remains fragile, and risks are elevated. Our key objectives for the coming weeks include:

- Risk Mitigation & Capital Preservation – Limiting exposure to further downside volatility.

- Strategic Adjustments – Leveraging options strategies and hedging to optimize positions.

Institutional interest in crypto remains robust, but traders should exercise caution in the near term, as further corrections could precede a sustainable recovery.

This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.

Episode 83 / Crypto Hedge Fund Sees 15.31% Growth, Reaching $5,904

| 37 seen

The Terramatris crypto hedge fund has rebounded significantly this week, with the fund’s value increasing to $5,904, representing a 15.31% gain compared to the previous week. However, the drawdown from the all-time high still stands at -24.44%, reflecting the broader market’s ongoing volatility.

This recovery follows a highly turbulent period, during which Ethereum dipped below $2,000, triggering forced liquidations and widespread panic selling. As of now, market sentiment remains fragile, but some relief rallies have taken place and Ethereum (our most suffered position, has climbed above $2,000 again)

The past week has seen a mix of volatility and partial recovery. While last week’s sharp selloff pushed Bitcoin and Ethereum to new local lows, some stabilization has been observed in recent days. Ethereum has rebounded from its lows, and Bitcoin has also seen renewed interest from institutional investors.

From a technical analysis perspective, we maintain a cautiously optimistic outlook over the longer term. While we do not rule out the possibility of a reversal to $2,500 in the coming weeks or months, we acknowledge that market conditions remain dynamic and unpredictable.

Despite the recovery, risks remain as macroeconomic uncertainty and liquidity concerns persist.

Portfolio Adjustments

With the sharp movements in crypto prices, our focus remains on capital preservation and strategic risk management rather than aggressively adding new leveraged positions. Given our significant exposure to deep in-the-money ETH put options, we implemented a strategic adjustment last week by partially restructuring these positions into covered calls on long perpetual futures. This proactive approach aimed to optimize risk management, enhance capital efficiency, and mitigate downside exposure while leveraging existing market conditions.

Currently, we are managing the following positions using long perpetual futures settled in USDC.

- 0.01 BTC (break even: $109,079)

- 1.1 ETH (break even: $2,816)

- 5 SOL (break even: $171.73)

Holding long futures incurs a performance fee; therefore, we aim to limit our exposure to perpetual contracts by converting to spot once sufficient cash reserves are available.

As we have call options expiring tomorrow (March 21, 2025) - we look to generate additional options premium thus lowering our break even price for ETH under $2,800, Bitcoin around $108,000 and SOL around $168.

No new capital has been injected into the fund, and liquidity remains a priority.

TerraM Token Update

The TerraM token has outperformed much of the broader crypto market, continuing to show resilience.

- Current TerraM Price: $2.60 (no changes week over week)

We remain committed to improving liquidity, but given market conditions, we do not expect a significant liquidity increase or another buyback until total fund value reaches $8,000.

Looking Ahead

The market is still fragile, and risks remain elevated. Our primary objectives in the coming weeks are:

- Risk Mitigation & Capital Preservation – Avoiding unnecessary exposure to further downside volatility.

- Strategic Adjustments – Using options strategies and hedging techniques to optimize positions.

- Liquidity Improvement for TerraM – Continuing efforts to stabilize the token’s price action.

While institutional interest in crypto remains strong, traders should remain cautious in the near term, as the market could see further corrections before a more sustainable recovery.

Disclaimer: This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.

Episode 82 / Crypto Hedge Fund Sees -34.49% Drop – What’s Next?

| 38 seen

As of March 13, 2025, the Terramatris crypto hedge fund’s value has sharply declined to $5,120, representing an enormous drop of -34.47% from last week. This decline follows a massive selloff in the crypto markets, pushing Ethereum below $2,000 and amplifying market-wide panic. Additionally, we repaid a $950 investment that we had received just last week, further impacting our capital reserves.

Market Overview

The past week has been one of the most turbulent in recent months. Speculation-driven panic selling and macroeconomic instability have fueled a severe downturn in crypto prices. Bitcoin and Ethereum both plunged significantly, with Ethereum’s break below the $2,000 level exacerbating losses for many leveraged traders. Sentiment remains highly fragile as traders assess the likelihood of continued downward pressure.

Portfolio Adjustments

Given the extraordinary volatility, we refrained from adding new leveraged positions and focused on damage control. Our primary approach has been capital preservation and strategic risk mitigation.

- Repayment of Capital: We returned a $950 investment that was received last week, impacting our available capital but fulfilling financial obligations responsibly.

- ETH Perpetual Futures Exposure: Currently holding 1.1 long ETH perpetual futures contracts, with a break-even price at $2,841. With Ethereum now trading at approximately $1,875, this position is deeply in the red, with a current loss of approximately -$966 per ETH. As we have call options expiring tomorrow (March 14, 2025) - we look to generate additional options premium thus lowering our break even price under $2,800

- Put Option Management: Given Ethereum’s decline, we have maintained a defensive approach and are not opening new put trades at this time. Instead, we are actively managing existing contracts and adjusting covered call strategies to mitigate losses where possible.

- Covered Calls Strategy: We continue to sell covered calls on our ETH positions to generate some yield and reduce overall exposure to further downside risk.

TerraM Token Update

The TerraM token on the other hand is performing better than the most of the market participants.

- Current TerraM Price: $2.60 (a noticeable increase from last week's $2.45)

- Liquidity & Slippage: While slight improvements were made, slippage remains a major concern. Exchanging 200 TerraM tokens to USDC currently incurs a -36.78% slippage, slightly better than last week’s -37.99%.

We are actively working on strategies to stabilize TerraM liquidity and mitigate extreme price swings. However, given the current market turmoil, improvements may take longer than anticipated. We are not expecting increasing liquidity or another buyback until total funds value reaches $8,000

Looking Ahead

Market conditions remain precarious, with further downside risk still a possibility. Our immediate focus is on capital preservation and risk management, ensuring we do not take unnecessary risks in an unpredictable market environment. While macroeconomic uncertainty persists, institutional interest in crypto remains strong, providing a glimmer of long-term optimism.

We will continue to monitor market trends and adjust strategies accordingly, aiming for stability and recovery in the coming weeks.

Disclaimer: This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.

Episode 81 / Portfolio Jumps to $7.8K After Strategic Restructuring

| 39 seen

As of March 6, 2025, the fund’s value has surged to $7,814.78, reflecting a 66.17% week-over-week growth ( +$3,111.80). This marks a new all-time high, surpassing all previous NAV records. The gain follows a strategic restructuring and capital injection aimed at preparing the fund for increasingly volatile conditions.

This week’s performance was driven not just by market momentum but by a deliberate consolidation into a single unified portfolio, designed to improve capital efficiency and resilience. To support this shift, $4,532 in new funds were added—borrowed capital that will be repaid over the next 10 to 12 months.

While this introduces short-term leverage, it reflects a calculated move to strengthen the fund's position ahead of expected market turbulence. The restructuring simplifies management, enhances liquidity, and creates room for high-conviction trades in the weeks ahead.

Episode 80 / Crypto Fund Plunges 23% as Ethereum Crashes

| 27 seen

As of February 27, 2025, the fund's value dropped sharply to $4,702.98, marking a $1,432.79 loss compared to the previous week. That’s a steep -23.35% week-over-week decline — the single largest percentage drop since inception.

The primary driver behind this downturn was Ethereum’s severe price crash. ETH experienced a violent sell-off, dragging down overall portfolio performance. While market corrections are not uncommon, the magnitude and speed of this drop caught many by surprise.

The primary factor behind this decline is Ethereum's (ETH) substantial price drop. On February 27, 2025, ETH's price closed at $2,305.48, down from $2,493.59 on February 25—a decline of approximately 7.5% in just two days. This sharp decrease significantly impacted the overall portfolio performance.

Market Dynamics and Ethereum's Volatility

The broader cryptocurrency market has experienced heightened volatility, with Ethereum at the forefront. After reaching a high of $2,839.01 on February 24, 2025, ETH's price began a rapid descent, closing at $2,305.48 by February 27. This represents a decline of nearly 19% within a span of three days.

Several factors contributed to this downturn:

- Market Sentiment: A shift towards bearish sentiment led to increased selling pressure across major cryptocurrencies, with Ethereum experiencing pronounced effects.

- Technical Indicators: Ethereum's price fell below key support levels, triggering stop-loss orders and further accelerating the decline.

- Regulatory Concerns: Emerging regulatory developments may have also played a role in dampening investor confidence, leading to the observed sell-off.

Strategic Response and Outlook

In response to the current market conditions, our strategy includes:

- Holding Positions: Maintaining our current holdings, including Bitcoin acquired at higher price points, with the expectation of a market rebound.

- Selling Covered Call Options: Generating additional income through options strategies to offset some of the unrealized losses.

- Market Monitoring: Closely observing market trends and technical indicators to identify potential entry points for future investments.

While the recent correction is challenging, we view it as a necessary adjustment within the volatile cryptocurrency market. Our focus remains on long-term growth, and we are prepared to navigate the current landscape with strategic patience.

Episode 79 / Crypto Fund Slips Under $6,200

| 20 seen

As of February 20, 2025, the Terramatris Crypto Fund's value stands at $6,135.77, reflecting a slight decrease of $56.40 from the previous week, marking a 0.91% decline.

During this period, Ethereum (ETH) exhibited modest gains. On February 20, 2025, ETH's price closed at $2,738.98, up from $2,715.47 the previous day. This uptick contributed to stabilizing the fund's overall performance amid a fluctuating market.

The broader cryptocurrency market experienced slight growth, with the total market capitalization increasing by 0.99% to reach $3.21 trillion. Bitcoin (BTC) traded between $95,407 and $97,363, closing at $97,200, up by 1.45%.

Several key events influenced the crypto landscape during this week:

- Regulatory Developments: The U.S. Securities and Exchange Commission (SEC) dropped its lawsuit against Ripple, leading to a 13.73% surge in XRP's price. This decision signaled a more favorable regulatory environment for cryptocurrencies. Business Insider

- Institutional Adoption: Mastercard reported a 20% increase in cross-border volume, partly due to cryptocurrency purchases, highlighting growing institutional involvement in the crypto space. Investors

Despite the minor dip in the fund's value, the overall market sentiment appears cautiously optimistic. Ethereum's steady performance and positive regulatory developments contribute to a favorable outlook. We remain vigilant, monitoring market trends and regulatory changes to inform our investment strategy.

Stay tuned for the next update as we continue to navigate the evolving cryptocurrency landscape.

Episode 78 / Crypto Fund Surges 6.28% to $6,192

| 17 seen

As of February 13, 2025, the Terramatris Crypto Fund rose to a portfolio value of $6,192.17, marking a $365.82 increase from the previous week. This represents a 6.28% week-over-week growth — a solid continuation of the fund’s upward momentum.

The crypto market during mid-February 2025 showed increased resilience, with Ethereum and Bitcoin consolidating recent gains. ETH hovered around the $2,550–$2,650 range, supported by improving macro sentiment and cooling regulatory fears. Implied volatility trended slightly higher, offering better premiums for option sellers — ideal for our short-duration strategies.

Our focus remains on scalable income generation via systematic options strategies, with potential expansion into multi-leg trades and layered volatility arbitrage as portfolio value climbs past the $6K mark. Risk remains tightly managed, and we're watching for any macro events that could disrupt current market calm.

Episode 77: Sliding Back — Fund Drops 4.28% Amid Crypto Market Stagnation

| 15 seen

As of February 6, 2025, the fund’s value has declined to $5,826.35, marking a -4.28% drop week-over-week, equivalent to a -$260.48 decrease in dollar terms. After a period of relative stability, this decline signals a potential shift in sentiment, as uncertainty once again clouds the crypto landscape.

Ethereum (ETH) mirrored the broader market softness, hovering around the $2,300 mark but failing to break out of its consolidation range. Despite strong on-chain fundamentals and steady Layer 2 adoption, ETH faced headwinds from weakening trading volume and cautious sentiment in the wake of stagnant macro data.

Traders seemed to be waiting on stronger catalysts before committing to new positions. This lack of direction contributed to ETH’s modest pullback, reflecting the overall hesitation seen across most major altcoins.

Meanwhile, some speculative altcoins that had rallied in January began to retrace gains, contributing to a more cautious tone

Looking ahead, much will depend on February’s macroeconomic data releases, continued ETF inflow trends, and any surprises in the regulatory environment. For now, the fund remains on the defensive, eyeing both resilience and new opportunities in the weeks to come.