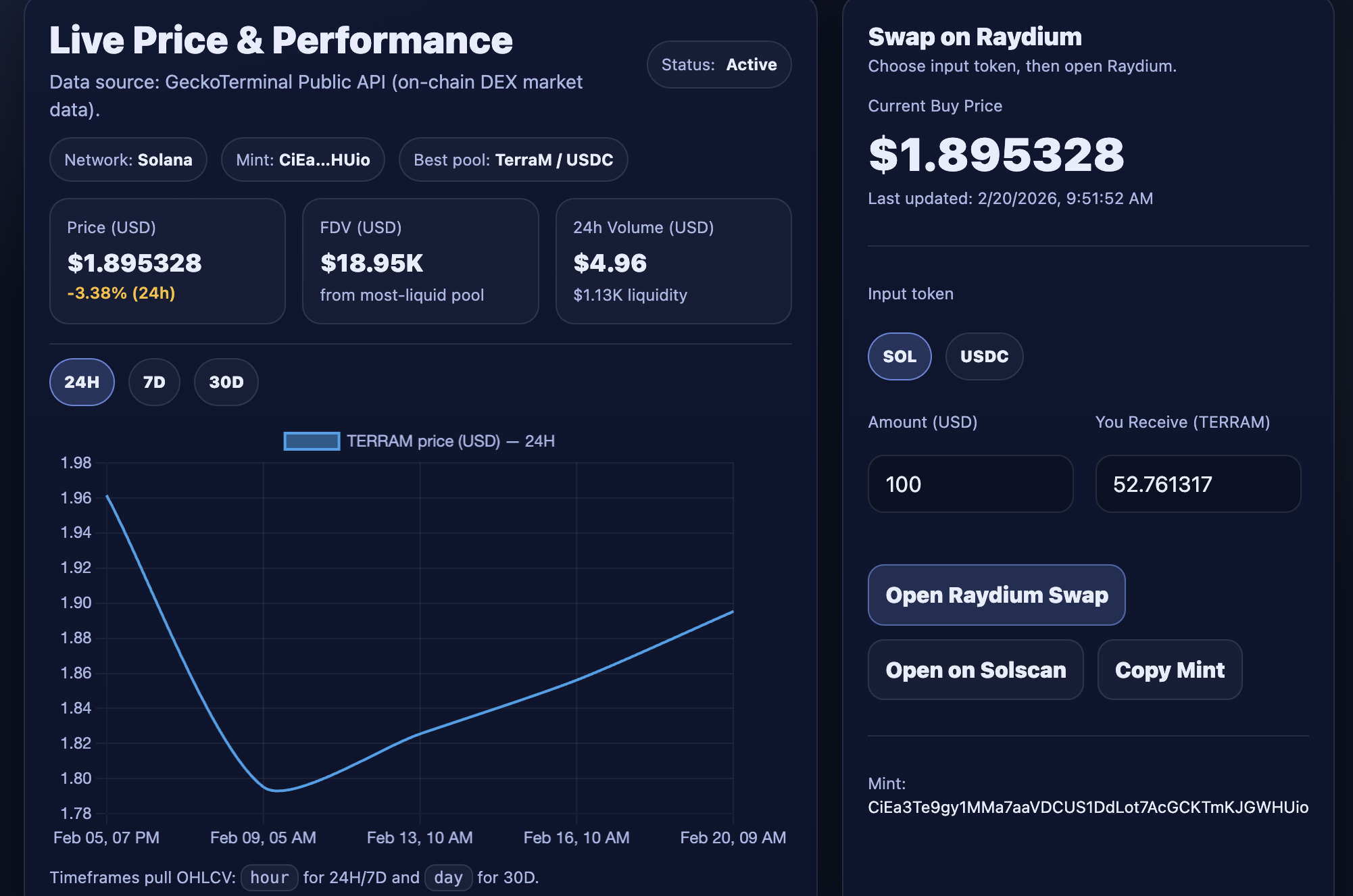

On February 20, 2026, the TerraM token traded at $1.89, up 3.84% week over week. On-chain activity was limited during the period, with two buys and no sells, which is a positive signal.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.95% of total supply. As a result, total market capitalization increased by approximately $700, reaching $18,900 week over week.

Our broader objective remains expanding liquidity coverage to 10%, with the next milestone set at 3%. We expected to reach this minor milestone already this week. However, two buybacks removed roughly 0.05% of liquidity from the pool, slightly delaying the move. We remain confident that the milestone will be reached next week.

Until liquidity deepens further, elevated slippage should be expected.

Ethereum strategy

Week over week our Ethereum strategy increased by 3.33%

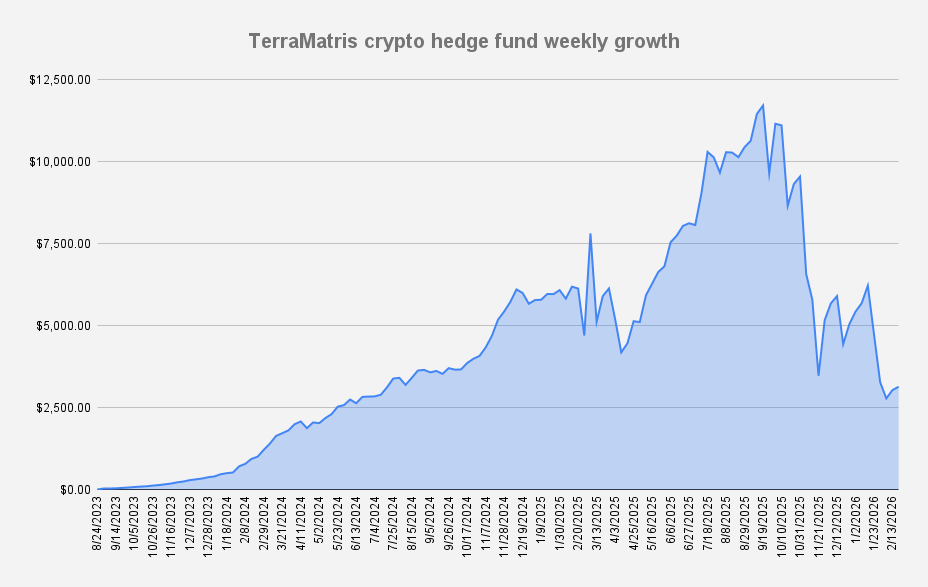

From the all-time high in September 2025, the fund is still down -73.20%. While YTD performance stands at -41.69%, underperforming ETH itself, which is down 34.01% over the same period.

During the week, the ETH Strategy generated $99 in options premiums, reducing the effective ETH break-even price to $1,784. By week’s end, the strategy held 2.025ETH with an average acquisition price of $1,982.

From the options premium received, we reduced margin to –$1,665. The immediate objective is to bring margin back to zero without selling any ETH. After that, depending on market conditions, we may increase exposure by adding 1 additional ETH on margin. Time will determine the right moment.

At an average premium of $99 per week, it would take approximately 17 weeks to eliminate the remaining margin balance — around mid-June.

Solana Covered Call Growth Fund

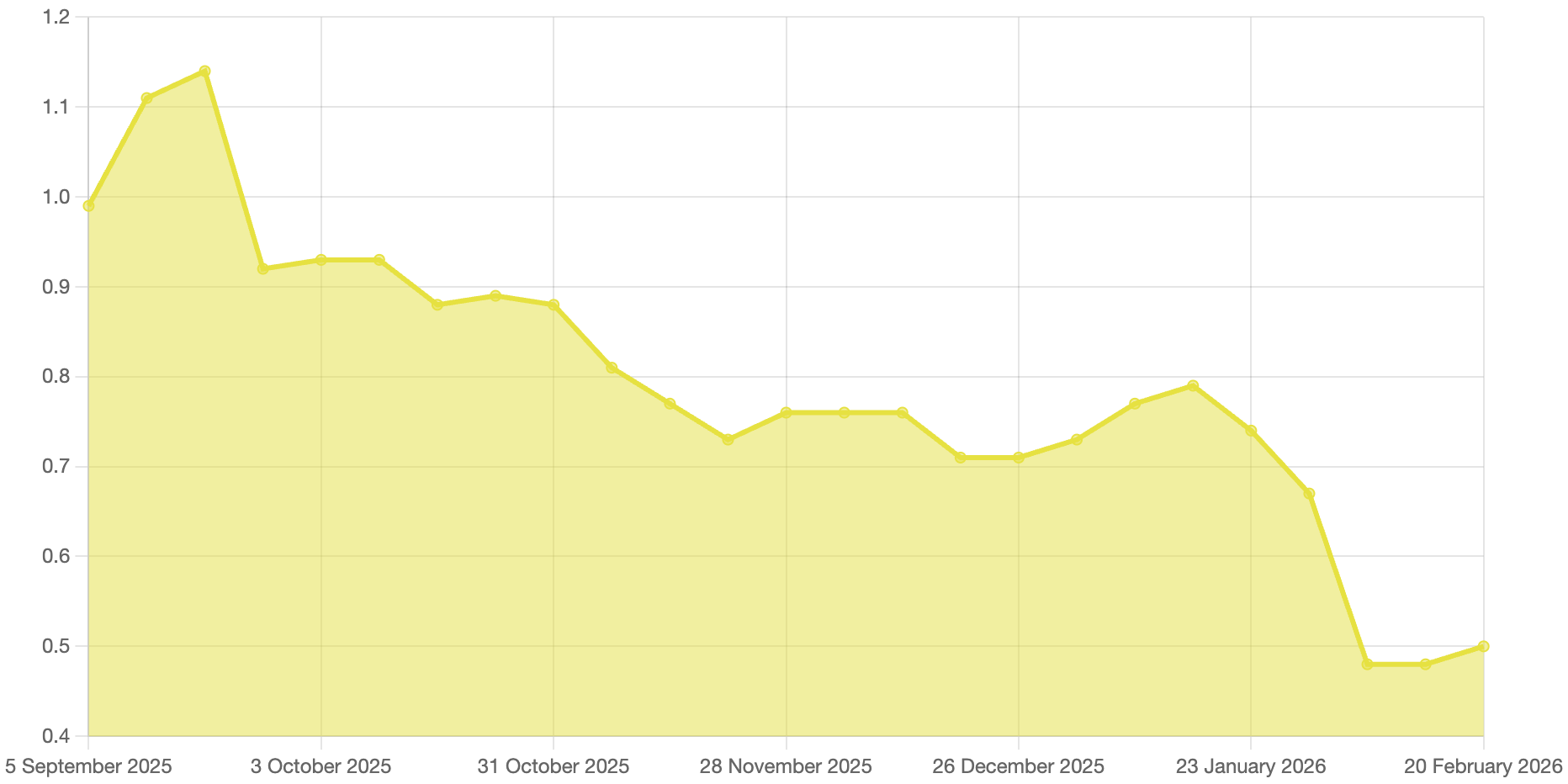

The Solana strategy increased by decent 5.24% week over week, with NAV reaching $0.50.

By the end of the week, we increased our long spot position to 52.29 SOL, with a buy price at $170.82 and break-even price of $152.95. With Solana trading at $83.33 at the time of writing, the position is significantly underwater.

During the week, we collected $29.54 in option premium from selling 6 covered calls expiring March 27.

At current volatility and premium levels, selling covered calls provides only limited downside offset and does not materially compensate for the unrealized losses.

We expect higher options income next week as the monthly contracts expire and we roll the positions forward.

The Bottom line

A solid week overall: all strategies posted gains, TerraM appreciated, and liquidity improved modestly. While slippage remains elevated, continued liquidity expansion keeps the path toward $2 per token realistic in the near term.

It may be tempting to aggressively scale the Ethereum strategy, but capital discipline remains the priority. We are deliberately avoiding tail risk while still operating on margin. Additional ETH exposure would only be considered on a meaningful pullback (approximately –5% to –10%), not into short-term strength.

The focus remains unchanged: reduce margin to zero, expand liquidity coverage, and compound option income without increasing structural risk.