Blog

Why We Decided to Invest in Liberland Dollar (LLD)

| Investment ideas | 91 seen

At Terramatris, we are always exploring opportunities that align with our values of innovation, independence, and forward-thinking. Sometimes, these discoveries come through structured research, and sometimes they appear unexpectedly. Our recent investment into Liberland Dollar (LLD) belongs to the second category — a pleasant surprise during our ongoing research into projects that combine crypto innovation with strong community values.

Over the past year, we’ve attended few crypto-related meetups and brunches in Tbilisi, Georgia, a city that has become a lively hub for blockchain conversations. At nearly every event, we’ve run into Samuela, an enthusiastic Czech representative of Liberland, who passionately shares updates about the micronation and its ambitions.

At one of…

Ep 109: TerraM Fund Weekly Report – Value at $11,719, +2.25% Weekly, +106% YTD

| Weekly updates | 40 seen

As of September 19, 2025, the TerraM crypto fund value stood at $11,719 what is an increase of +2.25% or +$257 in dollar terms when compared to the last week. Absolutely brilliant!

Last few weeks have been quite rewarding in crypto markets, with some type of consolidation forming.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our main TerraM fund is +106.33%. If the yearly pattern holds, we may be at the beginning of a run heading into Q4 2025. That said, we remain grounded and cautious.

Options IncomeWe sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $160 from options premiums, translating to a 1.36% weekly return on capital. Our…

Why We Launched Solana Covered Call Growth Fund

| Funds | 132 seen

On September 4, 2025, Terramatris LLC officially launched its Solana Covered Call Growth Fund, a specialized investment vehicle designed to combine the growth potential of Solana (SOL) with disciplined income generation through covered call strategies. The fund began with an initial seed investment of $100 from TerraM and a net asset value (NAV) of 1.00, setting the foundation for future expansion.

Economics Behind the FundThe economic rationale of the fund is straightforward yet ambitious. By holding SOL tokens as the core asset, the fund is directly exposed to the appreciation potential of one of the fastest-growing blockchain ecosystems. At the same time, by systematically selling call options against these holdings, the fund generates additional yield, enhancing returns…

Ep 108: Fund Surges +7.69% This Week, Doubling Value in Under 9 Months

| Weekly updates | 51 seen

As of September 12, 2025, the Terramatris crypto hedge fund value stood at $11,461 what is an increase of +7.69% or +$818 in dollar terms when compared to the last week. Absolutely brilliant!

The week turned out better than expected, with bold moves - particularly in Solana. Most cryptocurrencies are trending higher, and to our surprise, the small position we began building in Plume just a few weeks ago is already up 40%.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +101.79%. Absolutely remarkable - we’ve doubled the fund’s size in less than nine months. If the yearly pattern holds, we may be at the beginning of a run heading into Q4 2025. That said, we remain grounded and cautious.

Options…Episode 107 / Fund Grows 1.86% | New Solana Covered Call Fund & JUP Staking

| Weekly updates | 82 seen

As of September 5, 2025, the Terramatris crypto hedge fund value stood at $10,643 what is an increase of +1.86% or +$194 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

The past week started with some active moves — we even adjusted one ETH position by rolling it down and forward. However, as the days progressed, market activity slowed, and the week ended relatively calm, with little movement in crypto markets.

At this point, we might be entering a consolidation phase, setting the stage for a binary outcome — either the start of a bullish run or a sharp bearish attack.

As put sellers, we always remain cautious while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +87.38%.

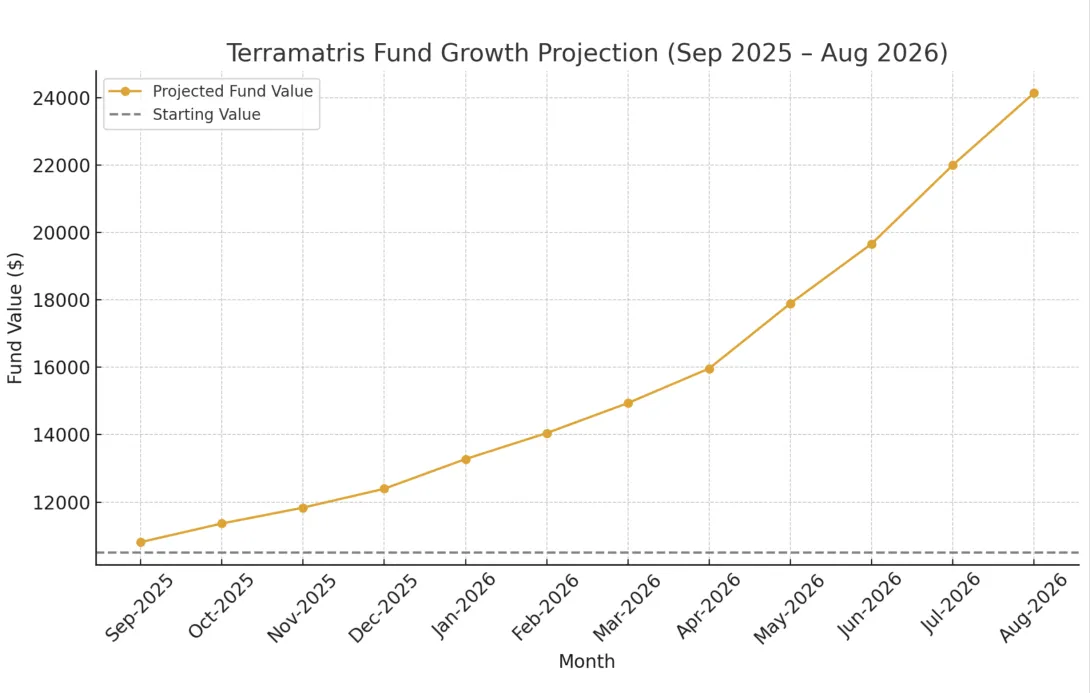

Options Income…Wishful Thinking, Statistics, and Modeling: Where Could Terramatris Fund Be in September 2026?

| Research | 61 seen

On September 2, 2025, the Terramatris crypto hedge fund stands at $10,500. Out of this, roughly $3,500 is low-interest debt, which we are steadily repaying at a rate of $300–450 per month. If nothing changes, we expect to be debt-free by April 2026. Importantly, there is no real pressure to return these funds quickly; and if market conditions turn against us, we believe we could borrow back on similar terms without risk to the core strategy.

This puts Terramatris in a comfortable position: a five-figure portfolio, a clear debt-repayment path, and a robust options premium strategy that has been delivering consistent weekly returns.

The Options Premium EngineOur core edge comes from selling weekly options—primarily covered calls and short puts.

Base case (regular weeks): $…Episode 106 / Ethereum Nears $5K as Terramatris Fund Surges +83.97% YTD

| Weekly updates | 161 seen

As of August 29, 2025, the Terramatris crypto hedge fund value stood at $10,448 what is an increase of +3.02% or +$306 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

Just like the previous week, this one was also marked by significant volatility. Ethereum (our bread and butter) surged to nearly $5,000 — a new all-time high — before pulling back to $4,360at the time of writing. We believe that if ETH breaks above $5,000, another major rally could follow — perhaps toward $7,000? That’s just speculation, of course. Nevertheless, as put sellers, we always remain cautious while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +83.97%.

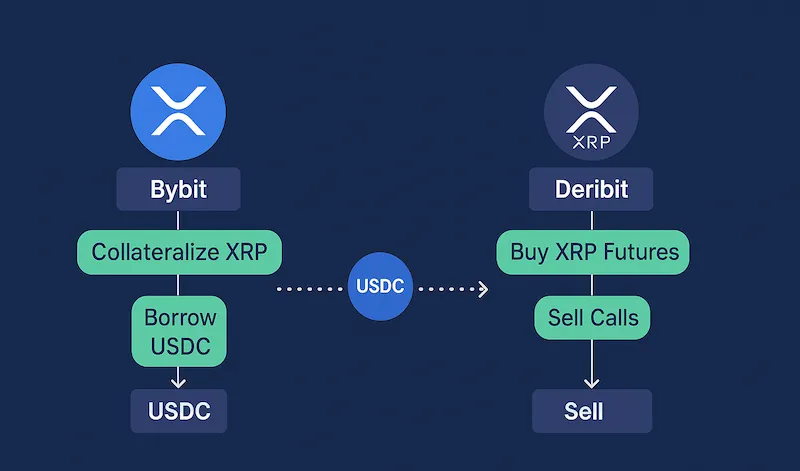

Current Long Perpetual Futures (USDT Settled)1.6 ETH – Break-even: $4…Trading Covered Calls on XRP with Deribit

| Crypto Options | 156 seen

At Terramatris we are always exploring new ways to structure option strategies around crypto assets. One of the more interesting challenges we’ve faced recently is figuring out how to trade covered calls on XRP.

Our favorite trading platform, Bybit, unfortunately does not yet offer XRP options. That left us looking for alternatives, and naturally, Deribit became our next candidate. Deribit does offer XRP options, but as always, the devil is in the details.

The Challenge: Collateral Rules on DeribitDeribit lists XRP options, but they are settled in USDC. At the time of writing, there is no way to post XRP directly as collateral for call selling. This complicates things because in a “classic” covered call setup, you’d hold the underlying asset (XRP in this case) and sell…

Episode 105 / ETH Volatility, Options Income of $170, and New Plume Position

| Weekly updates | 137 seen

As of August 22, 2025, the Terramatris crypto hedge fund value stood at $10,142 what is a decrease of -1.37% or -$140 in dollar terms when compared to the last week.

The past week has been quite turbulent, with Ethereum fluctuating between 4,600 and 4,000. At one point, we even considered hedging by shorting part of our position with perpetual contracts, but ultimately decided against it. The week ended on a positive note, as all of our weekly options expired worthless. The decline in portfolio value mainly came from the depreciation of our long-term holdings.

Despite negative performance in crypto markets we are still just a few hundred dollars shy of our all-time high recorded earlier this summer—an encouraging sign of the fund’s resilience and upward momentum.

…Episode 104 / Wyoming LLC Launch, Ethereum Rally & $137 Weekly Income

| Weekly updates | 85 seen

As of August 15, 2025, the Terramatris crypto hedge fund value stood at $10,283 what is a decrease of -0.11% or -$10 in dollar terms when compared to the last week. As we had some small business expenses last week (Registered agent service fee – Wyoming LLC incorporation), for which we used part of our fund’s capital, we still consider it another stellar week.

We are still just a few dollars shy of our all-time high recorded earlier this summer—an encouraging sign of the fund’s resilience and upward momentum.

YTD our crypto hedge fund is +81.06%.

Current Long Perpetual Futures (USDT Settled)1.7 ETH – Break-even: $4,697 | Short puts: $4,10013 SOL – Break-even: $199.38 | short puts: $180This week saw another strong rally for Ethereum, climbing from $3,900 to $4,…